Q&As

QI’m in my early 30s and I have invested in multiple non-KiwiSaver index funds (eg. S&P500, Vanguard World Fund, Simplicity Growth, Climate tech, etc). In each of these funds I have varying amounts from hundreds to thousands to tens of thousands of dollars. I spread regular deposits across these funds which means that it’s wide but thin.

I’m already maxing out KiwiSaver contributions (which is a total world fund for reference), so these non-KiwiSaver funds allow me to invest my surplus.

From a long-term perspective, would it be prudent to maintain this situation or consolidate these funds down to one or two funds instead? I assume this would reduce diversification a bit but would also mean I can “focus” the deposits and reduce admin overhead too.

AGosh. You have eggs in so many baskets you need a basket shop!

But wide diversification is great. And there’s no compelling reason why you shouldn’t keep investing in all the funds.

If they have considerable fixed fees — such as a hefty annual membership fee — that would be an argument against keeping all the funds going. Check that out. However, most funds have only minor fixed fees, or none at all.

The main charges in most funds are percentage fees. If those were all at the same rate, your total percentage fees would be the same whether you are in one fund or 100 funds. But if some have notably higher percentage fees than others, that would be one basis on which to drop some — although all the fees will probably be relatively low, given you are wisely choosing index funds.

Another issue is that you might find it a hassle to keep track of all your investments. If that’s the case, which ones might you get rid of?

Don’t pick the ones that have performed worst, especially over short periods. They could well be the best performers next time around.

Your S&P500 fund invests in all the big US shares, while your world fund invests in the biggest global companies. But 62 per cent of those global shares are North American, the vast majority of which will be US shares. So you’ll have a big overlap there.

You might want to drop the S&P500 investment. Just because the US market is the world’s biggest doesn’t mean it necessarily performs any better than other markets.

Then there’s your climate tech fund. Perhaps you would like to concentrate on funds of that type, which invest in companies with strong environmental records. The Mindful Money website can help you find them.

One other point: I’m not sure what you mean by maxing out your KiwiSaver contributions. It’s true that the most you can contribute via your employer is 10 per cent of your pay. But you can always contribute any extra money, on a regular basis or as a lump sum, directly to your provider.

But I wouldn’t necessarily do that, as that money is tied up for either a first home or retirement. You might as well invest elsewhere and keep your spending options open.

Whatever you decide to do, congratulations. You’ve made a great start to investing, and will almost certainly do well with it.

QA few months ago I opened a growth investment fund (as opposed to a KiwiSaver fund) with Simplicity, where I currently have around $10,000 invested.

I am 39 years old and plan on using this money for my retirement. However, I have chosen to put it in a non-KiwiSaver fund so I can withdraw it before then if I need to for unforeseen reasons. (I am also continuing to make regular contributions to my KiwiSaver account).

I plan on continuing to make regular contributions to this growth fund but am wondering if putting all my money in one managed fund is a good idea, or if it’s best to also invest in other low-cost index funds, such as Smartshares’ US500ETF.

A quick look at my Simplicity fund shows I am already investing in many of the companies in the S&P500, (which is what the Smartshares fund invests in) as well as in many other companies and bonds etc.

So is it worth spreading out my money in more index funds (and potentially buying more shares of the same companies), or just sticking with my Simplicity account and keeping things, well, simple.

AYou’ve got the opposite issue to the correspondent above. He worries about being in too many funds; you worry about being in too few.

What you’re doing is fine. But if I were you, I would consider investing some or all of your non-KiwiSaver money in a global share fund, such as the Vanguard one mentioned above. That gives you the ultimate diversification.

QJust to let people know, you can make 30-plus per cent per year investing in KiwiSaver in Australian resources, in SuperLife.

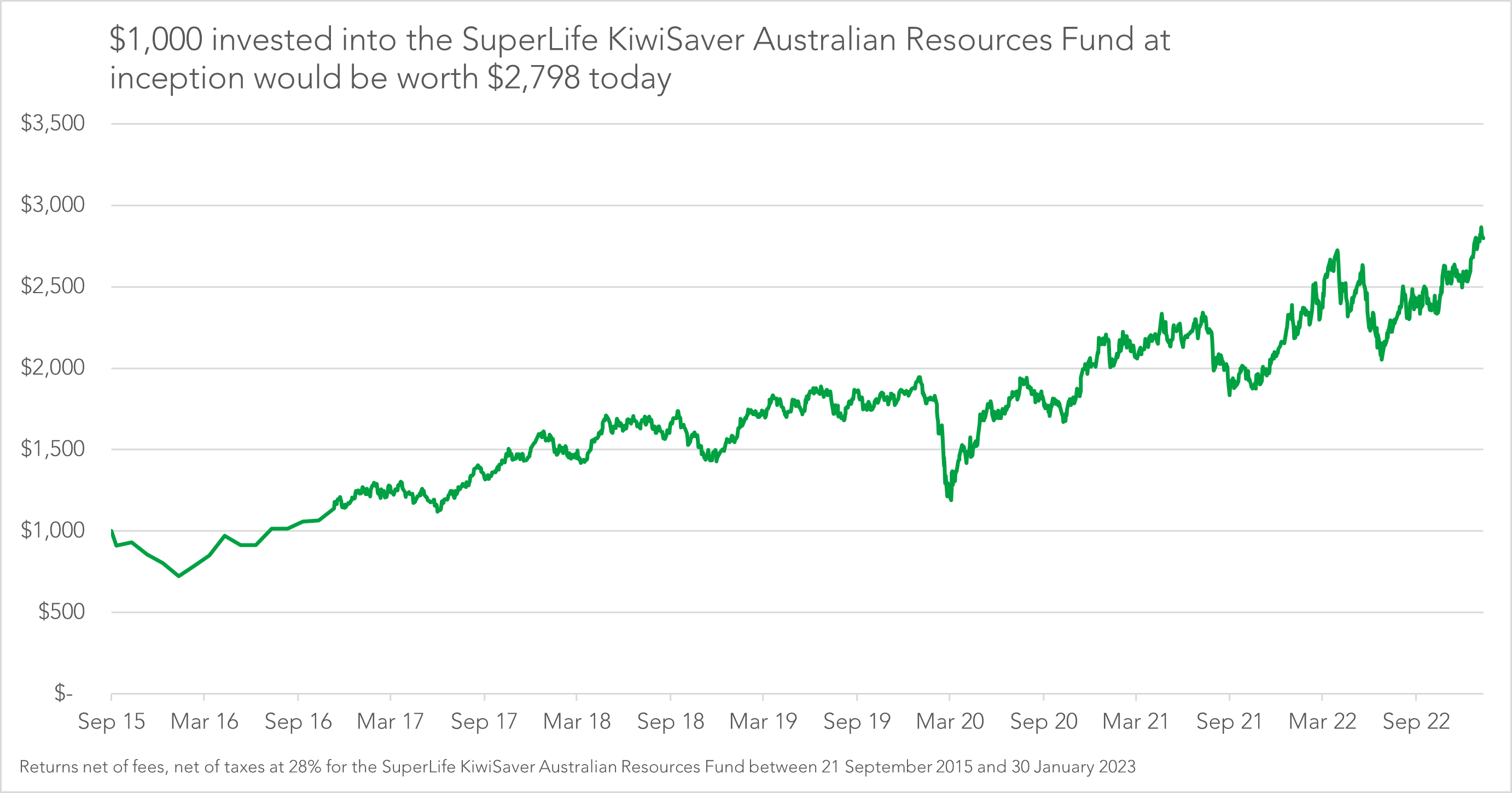

ATopping 30 per cent is nothing! The SuperLife KiwiSaver Australian Resources Fund reported a return of 59.7 per cent after fees and tax in the year ending 31 March 2021. And in the year ending 31 January 2017 it reported an eye-popping 70.2 per cent.

But there have been bad years too. The fund reported an annual return of minus 25.5 per cent after fees and tax in the year ending 31 March 2020 — at the time of the Covid plunge. It’s second worst annual return, since the fund started in 2015, was minus 9.1 per cent a month later, in the year ending 30 April.

There have also been some other downturns in recent years, as our graph shows.

Over all, though, the fund has returned a very healthy 15 per cent a year, after fees and tax, since 2015. If you invested $1,000 at the start, you would have nearly $2,800 now.

The fund’s only investment is in the Smartshares Australian Resources ETF, an exchange traded fund, listed on the NZX. The ETF has reported much the same returns, only slightly better, as the ETF fees are 0.54 per cent while the KiwiSaver fund fees are 0.59 per cent.

Should we all be investing in one of the two funds? Certainly not with the bulk of our savings. At any time, you can always look back and wish you had invested in a share or a fund that concentrates on a particular corner of the market. But will its good run continue?

“The funds follow the fortunes of the Australian primary resources industry (and more broadly the world economy),” says Hugh Stevens, Smartshares chief executive.

The funds invest “mostly in the Australian mining industry (69 per cent), with smaller exposure to oil and gas (16 per cent) and to iron and steel (10 per cent). Top holdings include BHP Group (39 per cent), Woodside Energy (11 per cent) and Rio Tinto (7 per cent).

“While the returns for the (KiwiSaver) fund have been exceptional, it is probably also quite important to point out that this fund was launched at the pretty much the bottom of the last mining and metals crash, and the members have greatly benefitted from a commodity boom cycle since then. But with slowing outlook for global growth you could see this trend begin to reverse.”

You have been warned.

There’s another issue here, too. These days, many investors would baulk at putting their money into these companies, given concerns about climate change and our future use of energy.

If that’s you, you might consider another SuperLife fund, the Ethica Fund, or other similar funds listed on mindfulmoney.nz.

QSome time ago I wrote to you asking why banks were stuck in a five-day working week when their computers were on 24×7 schedules. You agreed with me, but said the banks wouldn’t change.

Well, I’ve just received an email from Westpac saying they will be moving to 365 daily processing. Not sure what happens on Leap Year day!

All the banks will be doing this in May. Link is here.

AThat’s good news — although I suspect I’m not the only one who has never been all that bothered by this issue. But sometimes I’m sure it does matter to move money fast.

According to Payments NZ, which runs the system that transfers money between banks, “This upcoming change will mean Kiwis will be able to receive as well as send payments between banks every day of the year.”

By the way, I can’t find your earlier letter, but I doubt if I would have quite said the banks wouldn’t change. That seems pretty silly. But never mind.

QSaw the article last week about the lady that bought the home a year ago. Why would an intelligent person have bought a home when prices were driven up to ridiculous levels due to a once in a lifetime emergency interest rate environment?

It was obvious the interest rates were going to rise eventually, and it was obvious that the prices had risen out of control.

Did the prices fool you also Mary? Did you believe in those prices of late 2021? The whole country seemed to be fooled by it — euphoric and giddy with their newfound riches, and young people incensed with FOMO (fear of missing out).

Now many of them are in trouble. Why didn’t financial people in the media see it more clearly?

AI’m not sure what you mean by believing in prices. A price is whatever a seller is willing to sell for. Nothing to do with faith.

But anyway… on warning people, in recent years I have often said:

- House prices are way higher, relative to incomes, than they have been historically, and that can’t continue. At some point either prices will fall, or they will stagnate while incomes rise.

- It’s highly risky to buy a rental property and count on its price continuing to grow for the investment to work — especially over just a few years.

But I have also said, “Don’t try to time the market, for houses, shares or anything else. If now seems like the right time for you to buy a first home — perhaps for family reasons or because you want to know you can’t be moved on by a landlord — then go ahead.” I stand by that. Buying a first home is not mainly about making an optimal financial move.

Nearly always, once somebody has bought their first abode, they stay in the housing market — sometimes in the same house, sometimes moving from one place to another many times.

If they buy fairly young, by retirement time they look back on what they paid for their first home and it seems ridiculously cheap, regardless of what the markets were doing at the time of purchase. I think my husband and I paid $14,000 for our first place, in Wellington in the 1970s.

It’s true that people like last week’s correspondent who have bought recently are facing a short-term crunch, as interest rates rise fast on disturbingly large mortgages. But there are ways to cope, as I outlined last week.

Many years ago, when I was a reporter in Michigan, I wrote about a women’s bank. It was founded by people troubled when they saw that single women — often solo mothers — had trouble getting mortgages. The default rate on those mortgages was among the lowest of any bank.

Once someone has their own home — especially if they have struggled to get it — they will usually do anything to keep it. And in the long run, it works out fine.

QLoved the Rosie Robot bit last week! Especially the foul language in the last sentence! Great stuff.

AThat was Rosie at her worst. & per cent#)+# Oops, she’s done it again!

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm, ONZM, is a freelance journalist, a seminar presenter and a bestselling author on personal finance. She is a director of Financial Services Complaints Ltd (FSCL) and a former director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.