The FMA has commissioned Mary to write quick tips on investing:

The lazy person’s guide to investing — in and out of KiwiSaver

Pay down debt — including your mortgage — or save?

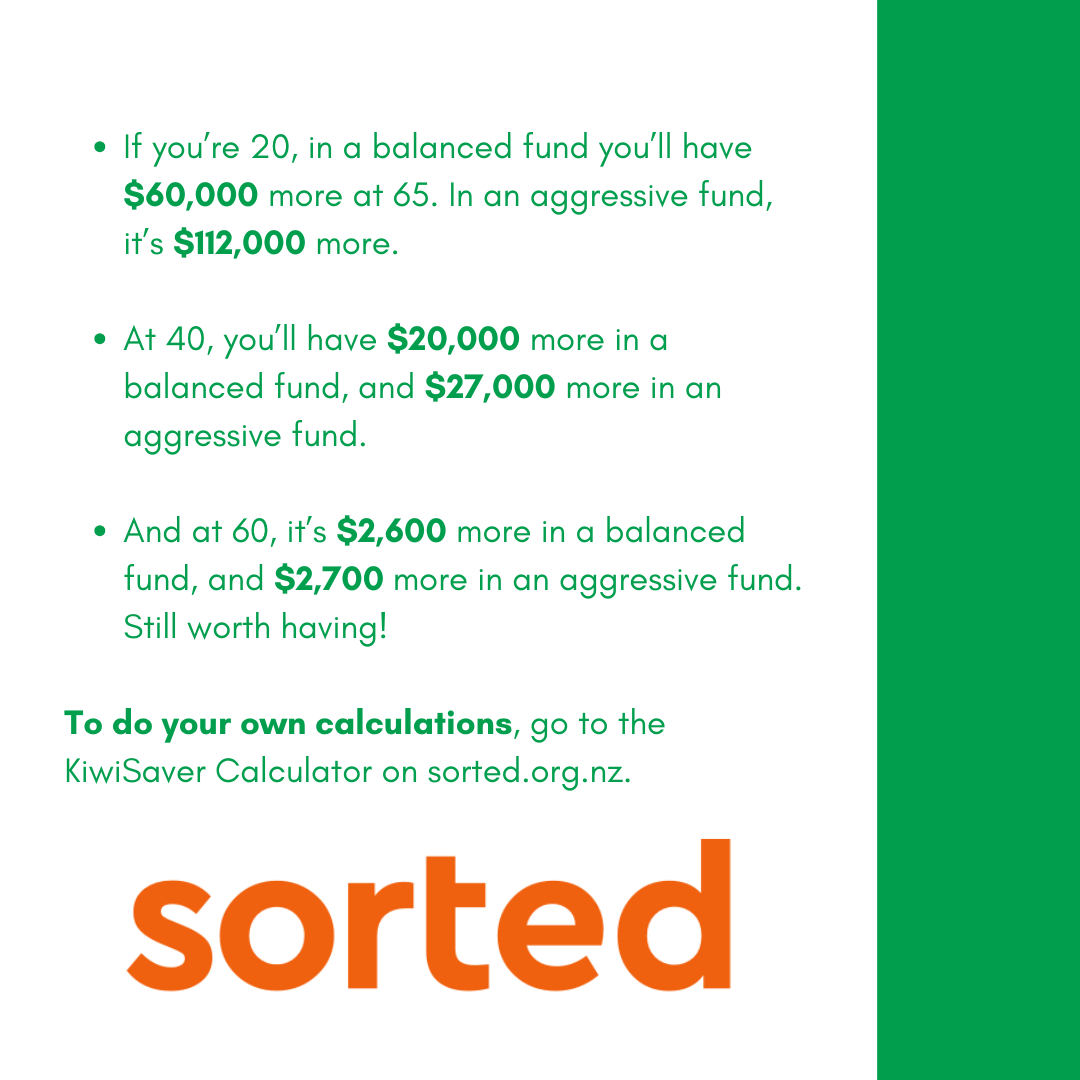

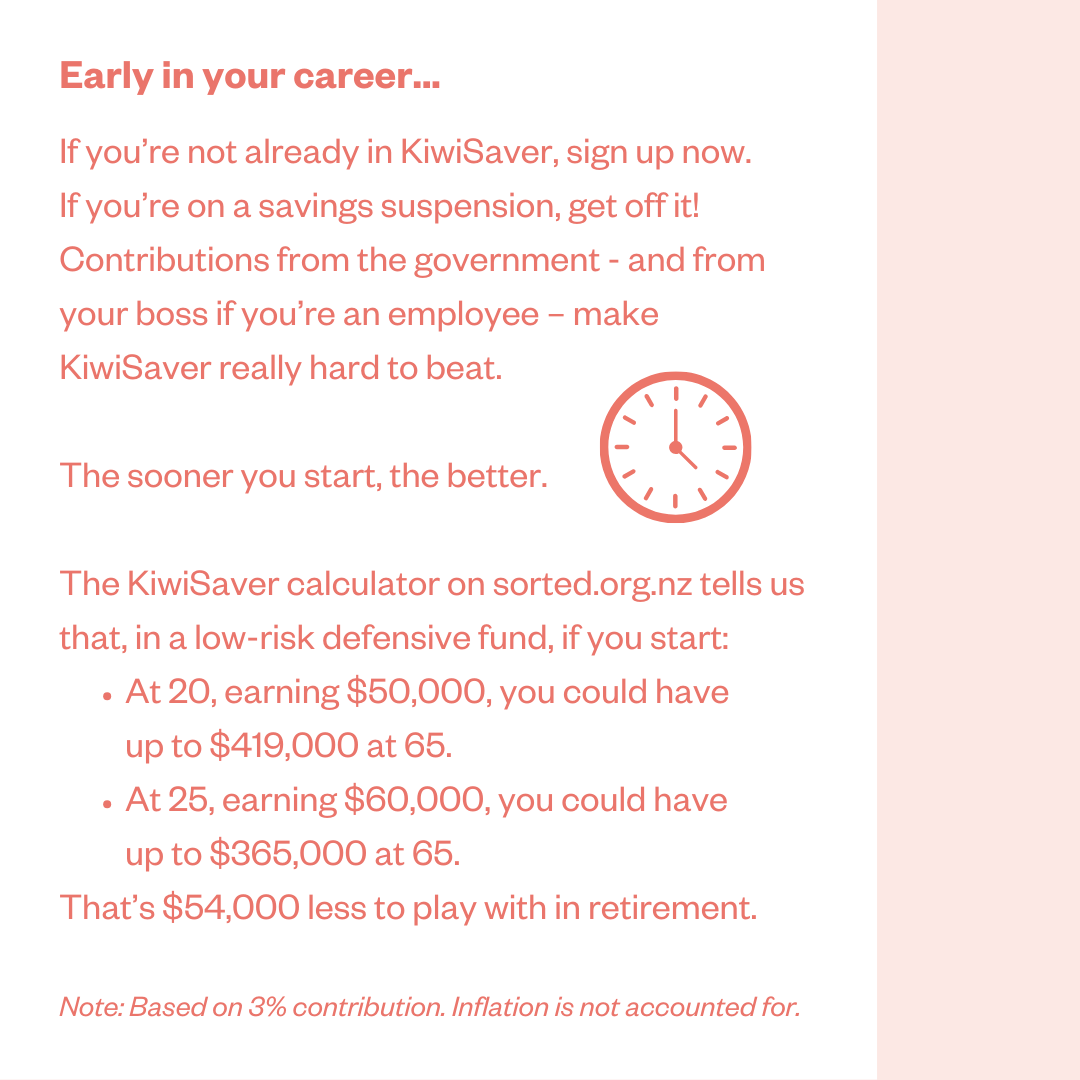

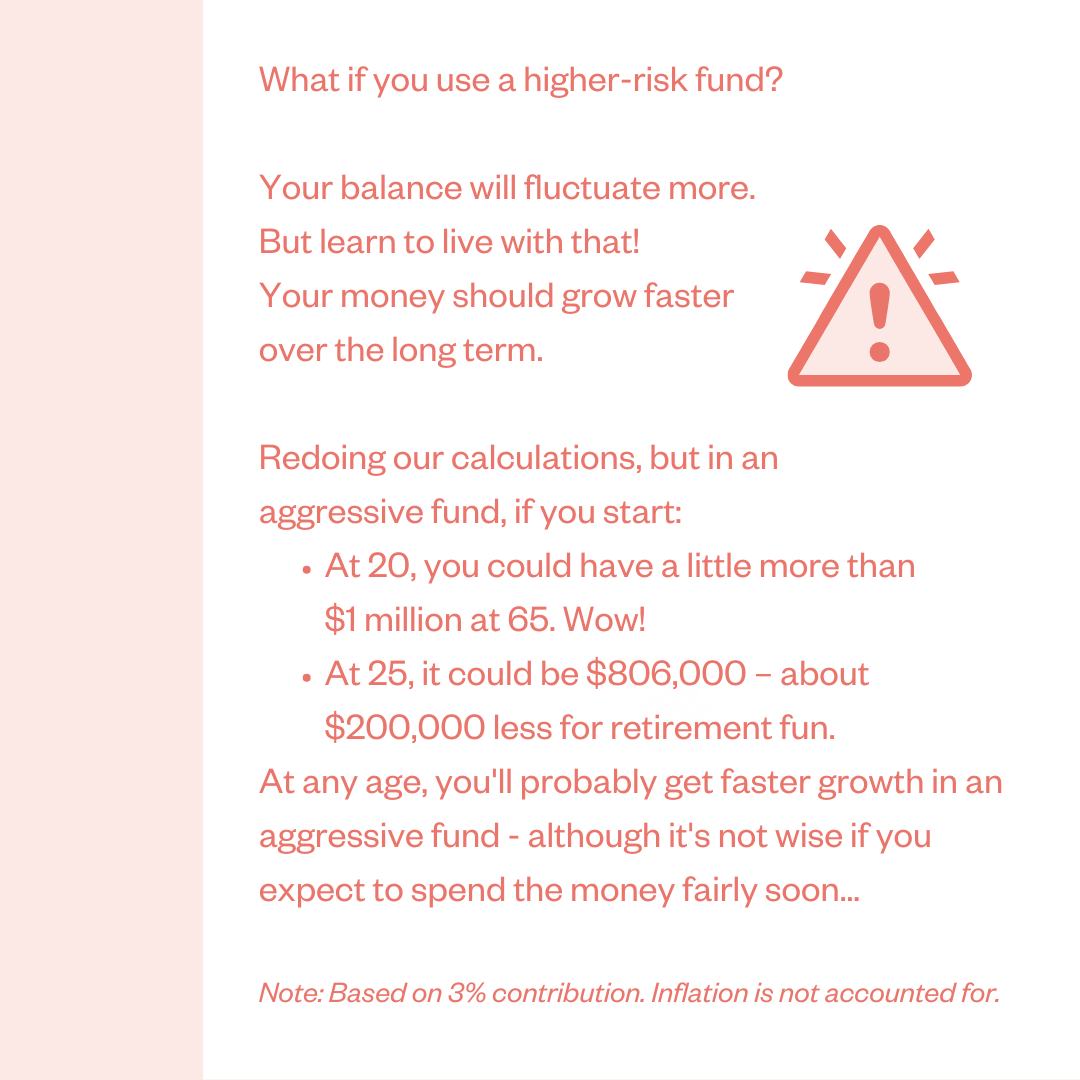

Make time your friend in KiwiSaver

Starting a conversation about money

Splitting KiwiSaver when a relationship ends

KiwiSaver tips for women at all life stages

How to pick a provider — for KiwiSaver and other investments

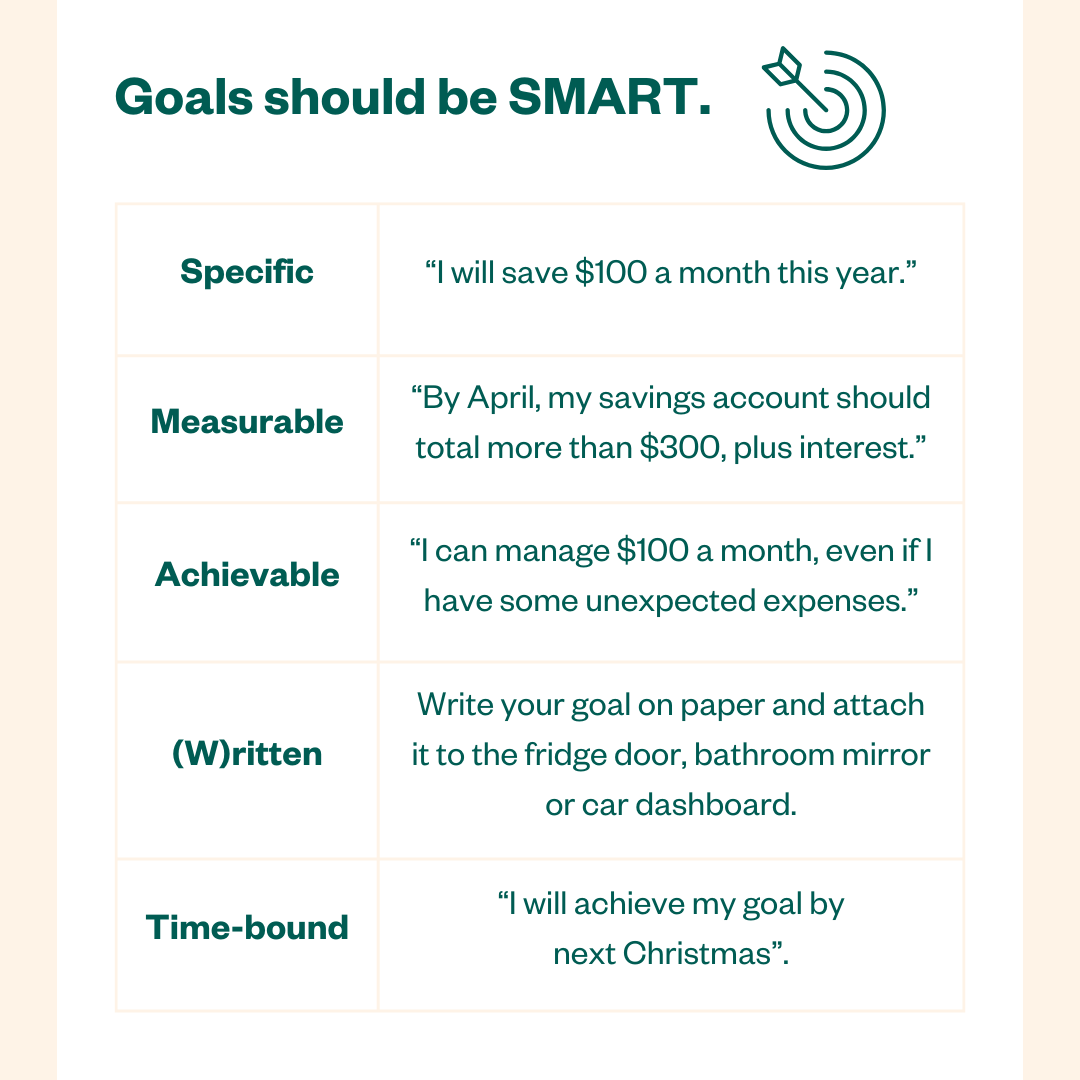

Setting financial goals for the new year

Christmas fun without the financial hangover

Achieving financial success without owning a home

Investing more ethically

KiwiSaver for a first home

Getting rich too quick

Taking a break from KiwiSaver

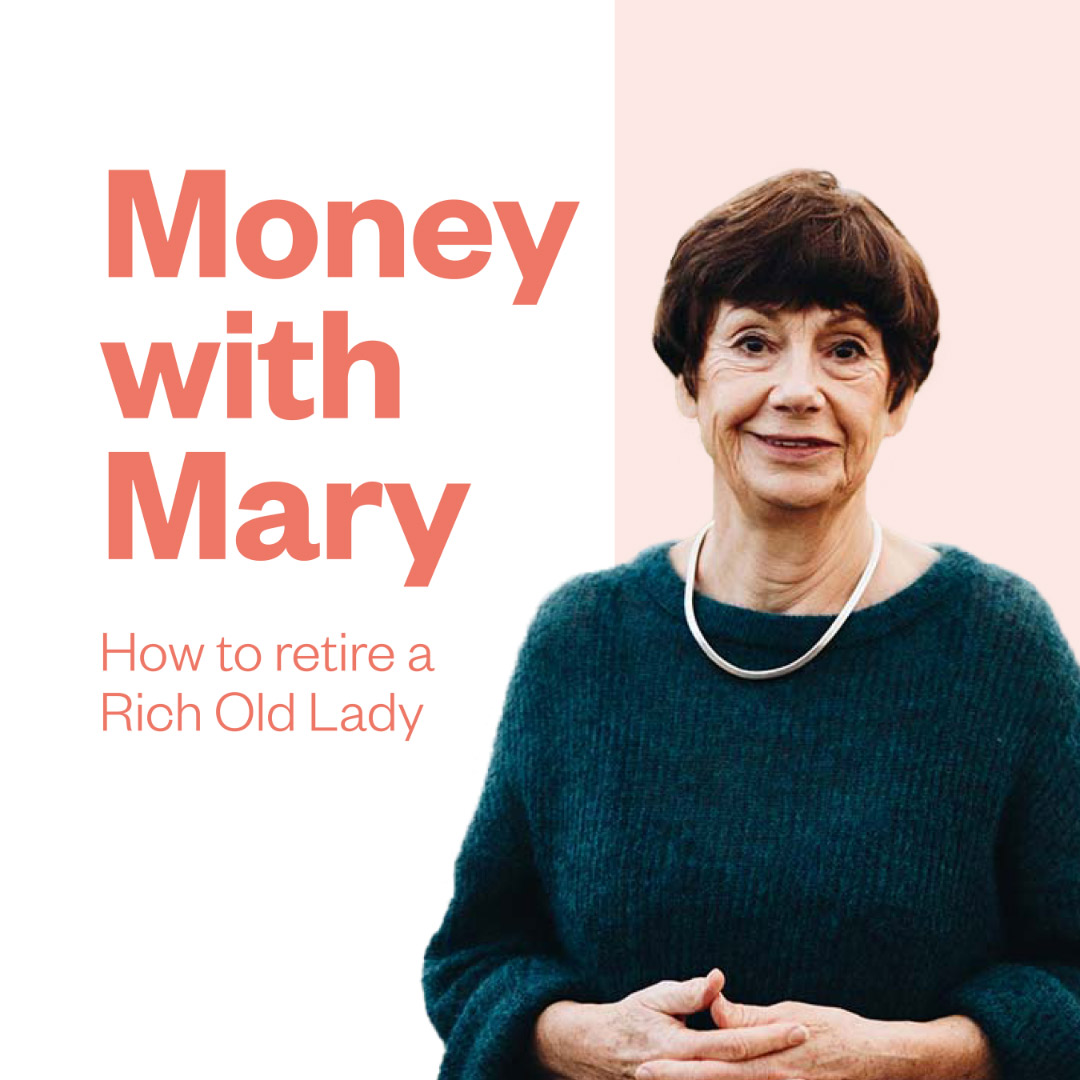

How to retire a Rich Old Lady

Make time your friend in KiwiSaver

Starting a conversation about money

Splitting KiwiSaver when a relationship ends

KiwiSaver tips for women at all life stages

How to pick a provider — for KiwiSaver and other investments

Setting financial goals for the new year

Christmas fun without the financial hangover

Achieving financial success without owning a home

Investing more ethically

KiwiSaver for a first home

Getting rich too quick

Taking a break from KiwiSaver

How to retire a Rich Old Lady