Q&As

Look for cheaper fun

QI’ve just read about a couple cashing in their KiwiSaver balances to buy their first home. They plan to start saving again for retirement in their 50s. This has got me thinking.

I was wondering what would happen if I cashed up KiwiSaver and bought a motorhome. Naturally if I needed the money for any reason, I could sell the motorhome, and bingo… money back in the bank. It would have been ideal to buy a bach by the beach, but the motorhome is a bit more realistic at current prices! So Mary, what do you think about cashing up the KiwiSaver for a bit of fun?

ANice try. But you’re going to have to delay your dream until you turn 65, and can withdraw your KiwiSaver money for any purpose.

In the KiwiSaver legislation it says members can withdraw all but $1,000 “for the purchase of an estate in land located in New Zealand.” A lawyer friend tells me that means a piece of land, with or without a house — or, I suppose, a motorhome — on it. But you have to buy the land, not just the motorhome!

If you buy bare land, you have to have plans to build on it. And you can’t use the money to buy a bach by the beach, unless you will be living in it as your “principal place of residence”. What’s more, usually it has to be the first home you buy, although in some circumstances people who previously owned a home but no longer do can also buy a home with KiwiSaver money.

I’m afraid you’re going to have to save for a motorhome outside KiwiSaver, or settle for cheaper fun.

Don’t forget dividends

QAs an avid reader of your column each week I have followed your advice to diversify my share portfolio. In October 2018 I traded my six separate NZ stock holdings and bought FNZ. This is supposed to be a weighted holding of New Zealand’s top 50 stocks in a passive fund. I bought at $2.52.

Some six years later their price is $3.11. That’s a pretty poor gain in six years, of about 23%. I checked the New Zealand stock market index over the same period. It went from 8,500 to the current 12,820, a gain of 51%. I fail to understand how my passive fund, that is supposed to track the NZX50, has failed to do so.

Luckily, I only sold six of my seven stocks. The seventh stock, Hallenstein Glasson, has grown from $4.62 to $7.23 in about the same period (bought June 2018), and it has paid out good dividends every single year.

I know you are going to say this is luck and I could just as easily have a bad stock (and I have had quite a few of those), but I bought the dividend stock because it has maintained dividends at that level for 60+ years, and I reinvest dividends in the market, unfortunately into FNZ. The capital growth is a super lucky benefit of it being a great company expanding into Oz.

Should I ditch my NZ passive stocks and buy more International? Is six years really too short? The mismatch between the official Top 50 and FNZ has probably got me the most worried. How could they be so far apart? I retire in 18 months.

AYou’re overlooking one really important thing: FNZ’s dividends.

“It appears the return quoted by your reader for FNZ only refers to the change in the listed unit price and does not include dividends received,” says Simon Beattie of NZX Ltd — which runs FNZ and other ETFs, which are share funds traded on the stock exchange.

“Dividends are an important component of the total return from FNZ and should be included to provide a meaningful comparison with the index, which also includes dividends.”

Unless you’ve chosen to have those dividends paid to your bank account — which I assume you haven’t — your dividends are reinvested in the form of extra units. So you should be looking at the total value of your investment, not the price of each unit.

FNZ, also called the Smart NZ Top 50 ETF, invests in the shares in the S&P/NZX 50 Portfolio Index, as well as a tiny holding in cash for liquidity. Its performance over the long term, before fees, tax and expenses, does in fact closely follow the index.

“FNZ has tracked its benchmark,” says Beattie. “It has returned 51.06% before fees and tax over this six-year period, or 7.12% per annum. Over the same period, the fund’s benchmark index has gained 50.75%, which equates to 7.08% per annum.”

After fees and tax, the FNZ return for investors has been 39.13%, or 5.66% a year since you invested. You can follow the returns on smartinvest.co.nz

By the way, Beattie also points out that it seems your comparison is with the S&P/NZX 50 Index rather than the Portfolio index. It’s an understandable mistake. But while both indexes invest in the same shares, in the Portfolio index no share makes up more than 5%.

This prevents domination by just a few large companies — notably Fisher & Paykel Healthcare, which makes up 17% of the non-Portfolio index. Getting rid of that domination reduces the risk that the fortunes of a single company can largely affect overall performance.

On your Hallenstein Glasson investment, I don’t need to say anything, as you’ve said it all for me! Oh, just one thing: even a long history of dividends can end.

In reply to your final two questions:

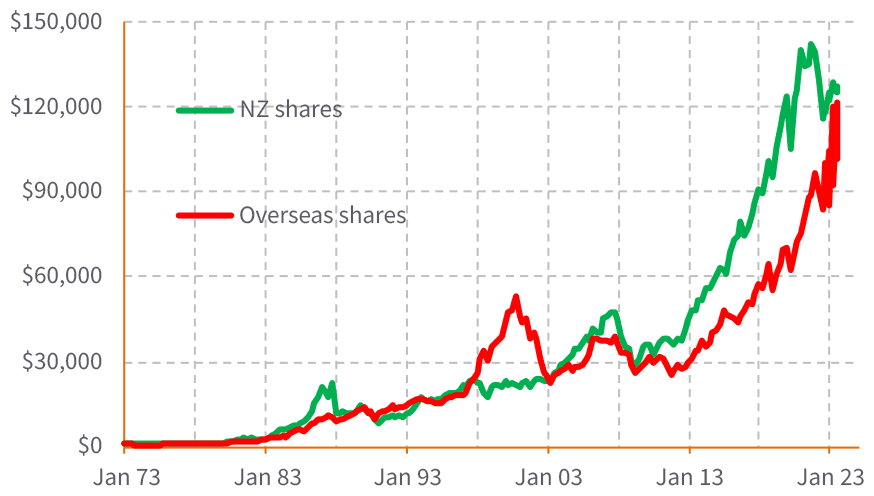

- It’s a great idea to have a good chunk of your long-term money in international shares. As our graph shows, NZ and world shares can follow different tracks over quite long periods. One good example is the different recent recoveries from the 2020 Covid plunge — with international shares doing much better, although who knows what will come next.

An easy way for you to go offshore would be to move some of your FNZ money to one of the Smart world ETFs.

- Yes, six years is too short a period to judge investments in shares or share funds. The graph shows how $1,000 has grown, after tax, with dividends reinvested, to more than $120,000 in 50 years. That averages more than 10% a year. Impressive. But there have been some prolonged downturns along the way.

Crash coming?

QSome people are saying that a 1929 style crash could happen again in 2029, after Trump leaves office, as the US stock market climbs to levels unseen in history! Pumped up by bitcoin and others trying to make a quick buck! Could it happen?

AOf course it could! And so could the opposite — a big downturn during Trump’s presidency, perhaps prompted by a realization that his policies aren’t working as well as people had hoped, followed by a dramatic recovery afterwards.

People can always come up with a feasible scenario about where the share market is headed, but more often than not they’re wrong. Accurately forecasting market movements is impossible.

What can you do about it? It’s simple really. Never invest in shares or a share fund unless you can cope — both financially and emotionally — with a big downturn at any time, and will ride it out.

Incidentally, stock markets often hit “levels unseen in history”. Long-term trends are always upward, helped by inflation.

Charity costs

QFurther to your listing last week of organizations that offer Christmas gift programmes, I suggest that anyone thinking of doing this check what percent of the donation is spent on overheads.

It’s nice to know that the bulk of your donation is going to the charity and not to salaries.

AI understand where you’re coming from. Every now and then we hear of a charity that seems to be squandering money. But they do have to cover running costs.

The CAB points out that charities often spend money on: rental of office space, vehicles and/or equipment, paid administrative staff, advertising, travel and collecting donations — in the street or by telephone. “They pay for these expenses from their income, of which a large proportion is donations,” it says.

“You can ask the charity what proportion of your donation goes to support the cause (as opposed to being used to pay administration and fundraising costs). You can also check their annual report and annual return.” There’s more about how to do this on the CAB website.

This is all fair enough. But I should add that I’ve thought of telling a charity, “You can spend my donation on admin.” That money has got to come from somewhere.

Luck too

QLast week you wrote “.. there is an element of good fortune in the story of every financially successful person.” Oh dear, where do I start?

Everyone makes their own luck, and hard-working people can multiply their financial luckiness by investing time and resources in business.

Although some were born into money and a few, as you suggest, married for it, try telling that to any of the rags-to-riches achievers like Sir John Key or Richard Branson. Or consider the many refugees who came to NZ with very little, and now run small businesses, and whose children excel at school.

Instead of belittling their achievements (and wanting to tax them extra), let’s celebrate their success. More of the Parable of the Talents and less of Mao Tse Tung’s philosophy of knee-capping “rich pricks” and tall poppies.

ANow it’s my turn to say, “Oh dear, where do I start?”

I wasn’t saying the success of Key, Branson or anyone else is all thanks to luck. Of course it’s not. I was simply responding to a reader’s comment that a wealthy couple’s “situation did not come about by luck, but rather hard work and sacrifice.”

I would be surprised if any honest wealthy person didn’t acknowledge they had a few lucky breaks, along with the hard work etc.

One more thing: My comment that wealthy people perhaps “met the right person at the right time” wasn’t about marriage but, more broadly, about coming across someone who encouraged them or opened doors for them.

Means test Super?

QThe recent letter from the man with $4.5 million invested and a $4 million home does highlight the urgent need to reform NZ Super. Why should people like the ones in your article be paid NZ Super at all? They clearly don’t need it, and when on a daily basis we read of funding shortfalls in health, soaring demand for foodbanks etc. it just seems plain wrong. Further, this is before you consider the impact of an aging population on future superannuation costs.

No doubt there will be the usual response that these people have paid tax all their lives so are entitled to NZ Super. This is a myth, because NZ Super is not funded like KiwiSaver or the Aussie Super scheme. Further, government super is means tested in Australia.

AYour argument certainly seems valid. But NZ Super is praised by experts around the world partly because it’s available to everyone.

Retirement Commissioner Jane Wrightson said in a recent Newsroom article, “The simplicity of its design is internationally envied. And New Zealand’s expenditure on its pension is both relatively low compared to other OECD countries and projected to stay there.”

If we means tested NZ Super, it would cost heaps to administer. And many of the wealthiest and sharpest would find ways around it, perhaps giving their savings to their children on the understanding they support them, or through clever tricks with trusts and companies. In the end, in trying to prevent that, the government might not save much at all.

In any case, people on higher incomes already get less Super, because it’s taxed.at a higher rate for them.

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm, ONZM, is a freelance journalist, a seminar presenter and a bestselling author on personal finance. She is a director of Financial Services Complaints Ltd (FSCL) and a former director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.