Q&As

QWe are a married couple in our early 30s and bought our first home five years ago, a two-bedroom. In 2021 we used equity to purchase a three-bedroom to move into, and kept the smaller house as a rental property.

Now we have our first kid, and my wife is on maternity leave, funds are very tight. We are tempted to sell our rental to have less of a mortgage and have less stress through the next few years.

Our parents’ generation tell us to continue to hold both properties and “tough it out”. While that may be good long term, I cannot help but feel we are paying far too much interest by holding both homes, and losing our best years to paying down excess debt — debt that we don’t have to have if we sell our rental property.

I acknowledge we are fortunate to be in this position. We just want to make sure we are making the right decision at this stage of our lives.

AThere’s no way to know whether selling the property and investing the proceeds in a KiwiSaver or non-KiwiSaver share fund — which is what I would recommend — would be better than continuing as you are.

It’s not just a question of whether share values will grow faster than house prices in the years to come. There’s also your mortgage.

Let’s say you borrowed $700,000 to invest in a $1 million property. You benefit from the growth not just on your $300,000 deposit but on the whole $1 million. That’s how property investors get wealthy.

But this bonus is not free. You pay interest for it. And while rental income will help, these days most mortgaged property investors find rent doesn’t cover mortgage payments, rates, insurance and maintenance, and have to put in extra money.

If you had invested your $300,000 deposit in a share fund instead, that extra money could have been added to the fund, month by month. And, with compounding growth, it would build up to a strong retirement fund.

People sometimes seem to overlook their inputs over the years when congratulating themselves on the gains they make on rental property.

So, despite what the “oldies” are saying to you, there’s no clearcut winner between a rental property and a share fund.

Your letter adds another dimension. Rather than putting into a share fund all the money you are currently putting into mortgage payments, you would like to free up some cash, and perhaps work fewer hours.

That means a share fund or other alternative investment probably wouldn’t grow as much as your rental investment. But that’s okay. Life isn’t only about monetary wealth.

I reckon you should sell the rental, invest the proceeds in a share fund that you add to when you are able, and go out and have some fun.

You should end up fine financially, given your good start. And you’re certain to end up better off emotionally. Many an older person wishes they had spent less time working and more with their children when they were young.

QI believe the returns KiwiSaver funds publish don’t reflect the true return. My provider shows the return after fees, I believe the true return should be based on before fees.

I figure the funders wouldn’t like to publish those returns as it would be lower. Your thoughts?

AYou’ve got it round the wrong way! When your provider tells you that your return is, say, 4 per cent after fees, that means they have subtracted the fees they charge you from the return.

If the fees total 1 per cent, the return before fees would be 5 per cent. I’m sure the provider would prefer to use that number, but the regulator has said they must use the after-fees return — which I applaud.

QThere were some questions in your column recently about making withdrawals from selected KiwiSaver funds out of a group of funds with varying risk levels or profiles.

My question is: Why have more than one fund? Each fund carries diversity within it.

Do two funds actually improve diversity, over a well-chosen single one, or just complicate things?

AGood question! For many people, there’s no need to be in more than one fund — in or out of KiwiSaver. Almost all funds hold a wide range of investments, giving good diversification.

If you plan to withdraw pretty much all your KiwiSaver money in one go — say to buy a first home — I recommend reducing your risk level step by step. By the time you are within two years of probably buying a home, it’s best to be in a lowest-risk cash fund. Then your balance won’t suddenly plunge right before purchase time.

But that doesn’t involve investing in more than one fund at the same time.

There are, however, two situations in which it works well to be in more than one KiwiSaver fund with the same provider:

- You’re investing for the long term and don’t plan any withdrawals for more than ten years. You’re using a low-risk conservative fund or a middle-risk balanced fund because you don’t think you would cope with seeing your balance fall much. The wobbles in recent years — unusual though they may be — were bad enough.

You’ve read, though, that your money is likely to grow more in a higher-risk fund, despite bigger wobbles along the way. It seems a pity to miss out.

Start by moving, say, a quarter of your money into a growth or aggressive fund. Then watch, over the years, as that balance fluctuates. As you grow more confident that the fund will always recover, move more into it.

- You are within about ten years of starting to gradually spend your money — in most cases as you approach retirement.

It works best at that stage to divide your money into three funds. Put the money you expect to spend within the next two years or so in a lowest-risk cash fund — sometimes called a defensive fund. You know that balance won’t drop just before you make a withdrawal.

Put the money you expect to spend in about two to ten years in a middle risk fund, ideally a bond fund. And put the longer-term money in a higher-risk fund. Every now and then, move some money down from each fund to keep the time frames working.

As I said in the column recently, just three providers — AE, Juno and Simplicity — don’t let members invest in more than one fund. It would be great if they changed that.

QYour correspondent two weeks ago wonders how the house buying arithmetic can add up for both a landlord and for their own children purchasing their own home.

For me, landlording can be made to work because one has control over one’s assets. (Anyone alive in the 1980s knows how catastrophic it is to give that control to NZ business.) And because of a so-far-good capital gain for property built in the right place.

You can’t become a landlord on rental income, but when you earn your money elsewhere, residential housing is still a safe(ish) place to put it.

It’s good for tenants too. I charge $4,000 a month for the places I built and let, but if any tenant walked into the bank with the deposit they needed to buy one, it would cost them more than $12,000 a month plus rates and insurance for 30 years to buy it. Being a landlord doesn’t get you wealth but it does help you store it.

For your correspondent’s children, they should know that buying a house to live in is still the surest way to a secure way of life and retirement. We all struggled to buy our first house.

AOh dear, are we still harking back to the 1987 sharemarket crash? That was awful for investors in shares. But it was fuelled by many people borrowing to invest in companies that also borrowed to invest. And investors didn’t spread their risk. It all got stupid. But we’ve learnt our lesson.

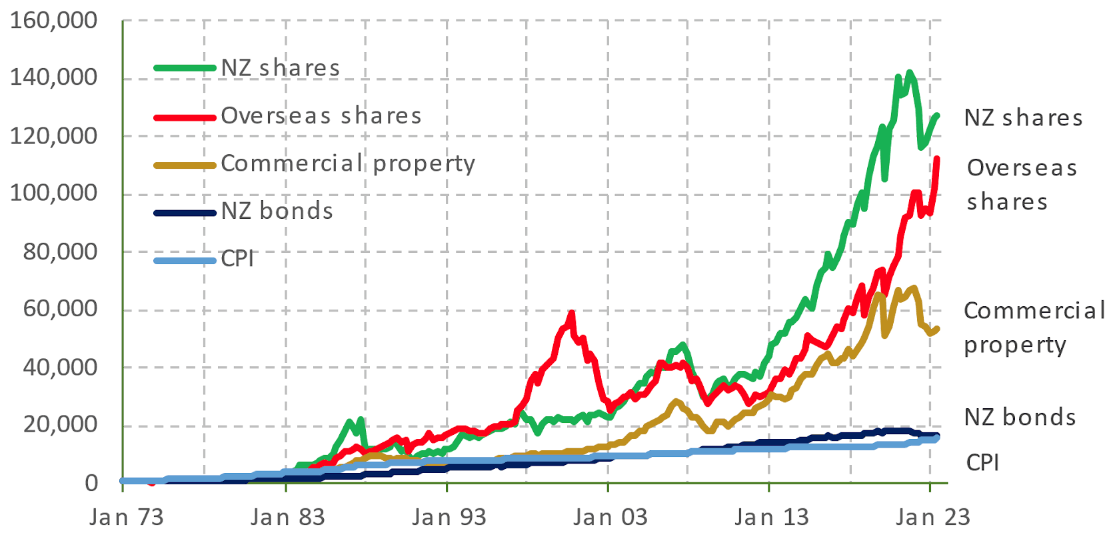

Our graph shows that an investment in diversified New Zealand shares — as opposed to in just a couple of much-hyped companies — roughly halved in that crash, and it took several years to recover. But recover it did, for those who stuck with their investments.

And look what’s happened since. By now, a $1,000 investment 50 years ago has grown to well over $120,000. That’s way, way ahead of inflation — shown at the bottom of the graph. Extraordinary.

What’s more, if you were wise and also invested in overseas shares, the 1987 crash wasn’t nearly as bad, as you can see in the graph. On the other hand, global shares suffered the bursting of the tech bubble at the turn of the century, while New Zealand cruised on by.

Both market indexes plunged in the global financial crisis of 2007 to 2009. But since then, global share growth has been almost as strong as in local shares.

The graph doesn’t include rental properties, as there isn’t good data on that. However, commercial property, like shares, suffered in 2007 to 2009, but has also grown well, although not as fast as shares.

Meanwhile, property investors like you prefer the more hands-on approach. And fair enough. House price gains have also been huge over the last 50 years, despite some dips — including my 30 per cent loss around 1990, which I wrote about last week. It was highly unusual, but it did happen.

Over all, I’m not sure that parking money in a rental property is particularly safe, especially for those who — unlike you — own just one property. We’ve seen recently what can happen to single properties. Just like shares, property investment is much safer if you diversify — although it’s harder to do with rentals.

Nor am I convinced by your comment about tenants. The fact that they get a good deal out of renting underlines the fact that houses are overpriced.

Let me be clear: I’m not saying rental property is particularly risky, especially if you plan to hold it over a long period. But you don’t want to be counting on price rises over just a few years. I wouldn’t attach your word “safe(ish)” to property.

Finally — and I acknowledge that I’m being tough on you! — your last comment about everyone struggling to buy a first home is the kind of statement that enrages young people. I don’t know how old you are, but I bet the ratio of house prices to incomes was lower when you were young.

QYou are absolutely correct in stating that our house prices are high when conventional investment pricing logic is applied.

I consider that house price inflation reflects the shallowness and immaturity of our private investment market. This market is so thin and devoid of sensible and profitable investment opportunities, that by default, real property — housing that is — has become our de facto investment default option.

As a result, demand driven forces inevitably bid up prices and the housing market becomes dysfunctional, with house prices — mere bricks and mortar — taking on Dutch tulip attraction to “investors”. Note, not to homeowners, including cash-strapped young families only interested in a roof for their kinfolk.

Sad but true, and until better investment opportunities become the norm, we will all be house investors paying over the odds, when acting as “homeowners.”

AI’m not exactly sure what you mean by private investments. Perhaps you mean backing start-up companies. Or perhaps it’s shares in general?

Anyway, a wide range of shares are listed on the NZX — our stock exchange. There are many good profit-making companies amongst them. And it’s easy to also get into international shares via New Zealand-run funds, in and out of KiwiSaver.

Diversified shares are clearly a good alternative to rental property, as our graph shows.

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm, ONZM, is a freelance journalist, a seminar presenter and a bestselling author on personal finance. She is a director of Financial Services Complaints Ltd (FSCL) and a former director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.