Q&As

QI am 25 years old, maximise my contributions to KiwiSaver and am in a growth fund. I currently have $17,000 there, and another $20,000 in various index funds through Sharesies. I try to save an additional $850 each month to put into my index funds (ASX, S&P).

Given that property ownership in Auckland seems so expensive, and the long-term returns on broad index funds so consistent, is it appropriate to think that I can get by and excel financially without owning property directly?

I can’t see myself moving away from Auckland, but it seems even more unrealistic to think that I’d be willing to fork out my life savings on a property!

Are there any pitfalls I may be walking into, and is this a trend you see emerging in younger generations?

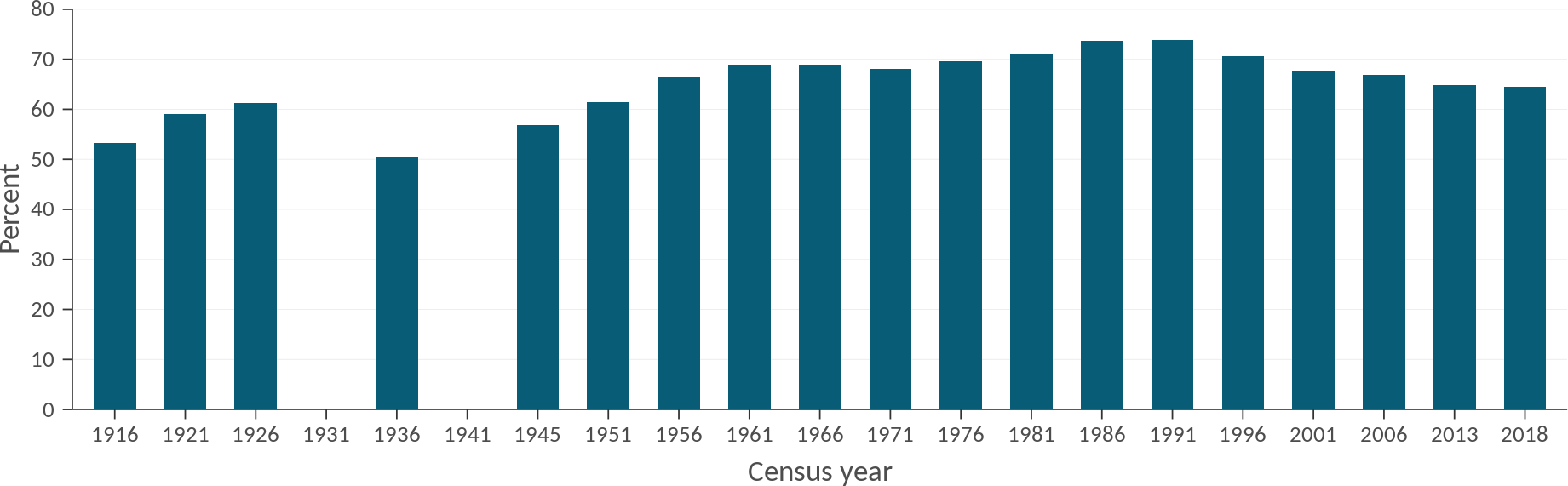

AThere has certainly been a trend towards fewer households owning their homes over recent decades. As our graph shows, the number peaked at 74 per cent in the early 1990s, and has since dropped to just under 65 per cent in 2018.

Proportion of Households That Own Their Own Home, 1916–2018

Note: Census not held in 1931 and 1941; 2011 Census delayed to 2013 because of Canterbury earthquakes.

Source: Stats NZ (2020). Housing in Aotearoa: 2020. Data from 1916–2018 Censuses. Licensed by Stats NZ for reuse under the Creative Commons Attribution 4.0 International licence.

However, there was little change between the 2013 Census — with 64.8 per cent owning their home either directly or through a family trust — and the 2018 Census, when it was 64.5 per cent. It will be interesting to see the numbers in the next Census.

But you’re interested in how many don’t own their homes by choice. The only data I can find on that is a survey of renters by Consumer NZ a few years ago. It found that 64 per cent rent because they can’t afford to buy. But 26 per cent said, “It suits my lifestyle right now”, and 5 per cent said, “I like the flexibility of renting.”

Anecdotally, it seems as if more people are choosing to rent — prompted partly by the still ridiculous New Zealand house prices relative to incomes.

And the only pitfall I can see is that you might not save enough for your retirement. Obviously you’ll need more to cover your accommodation later in life than people with mortgage-free homes.

But you have plenty of time to grow your savings, and you’re already heading in the right direction, with your high level of saving and your choices of a KiwiSaver growth fund and index funds. Your balances will fall quite far sometimes, but over the long run your savings will probably grow far more than in lower-risk funds.

Whether you will end up better off than if you bought a home is anybody’s guess. I’ve seen analyses that come out either way. It depends on your assumptions.

One advantage of home ownership is that you benefit from gearing, or borrowing to invest. Nearly everyone takes out a mortgage to buy their first home. And assuming the house value grows — which is almost certain over long periods despite current trends — you benefit from growth on both your deposit and the borrowed money.

You can actually gear your investments in share funds too, if you can find someone to lend you the money. But most people regard geared share investments as too risky, because share markets tend to be more volatile than house markets. If you’re forced to sell for some reason when share markets are down, you can end up with no shares and still owing money.

On the other hand, there are lots of costs associated with home ownership. An obvious one is mortgage interest, which — as we have seen lately — can suddenly rise. There are also rates and insurance, which can total quite a few thousand dollars a year. And maintenance can suddenly cost a heap and be quite a hassle, whether you do it yourself or hire someone. By contrast, your current investments cost you very little, being low-fee funds, and take little time or effort.

If you ask a home-owning friend how much they spend on interest, rates, insurance and maintenance, and save an equal amount, there’s a good chance you will hit retirement as well off as your friend.

There are, however, non-financial things to consider. Many people take pride in home ownership. And as you get older, and perhaps have children, you or your partner may want the security of living in a place where no landlord can ask you to move on.

Or you may want to be able to garden, decorate or do DIY projects knowing you will benefit from them.

Then again, as a presumably desirable tenant, you may be able to negotiate a long-term lease that would guarantee your occupancy for a certain period, and permit you to develop a garden and so on.

In Germany, just over half the people rent their homes, according to the European Commission. Many of them stay in the one place for decades. It can work fine.

And when you want to move, that process is a lot simpler for a renter than a home owner.

Over all, your plan looks good to me. What’s more, you can easily change your mind and switch to home ownership at any time.

By the way, on your comment that “the long-term returns on broad index funds (are) consistent,” that’s sort of true. Certainly if you look over ten years or more, the returns are usually positive and often pretty high. But don’t assume that the next ten years will always be the same as the last ten years.

QNo question but information and tips for others.

I lost my wife of 50 years last July. Like many others we had almost everything in joint names. As far as bank accounts and shareholdings in New Zealand were concerned, that worked well — it was quite easy to have them transferred to a sole name.

The credit card was less simple. There were a lot of intrusive questions about my income with only NZ Super, and in the end I received a much lower credit limit (but no annual fees). My card had a different number, and some payments that would otherwise have rolled over did not.

Shareholdings in Australia turned out to be much more complicated, involving lots of forms, original certified copies of documents and the current very slow mail.

Like many others we were persuaded many years ago that a family trust was a good idea. It may have been at the time, but a lot of the advantages have been legislated away.

Transferring the Australian shares held by the trusts is still ongoing. Some of these started out as dual listings. The Australian process involves the withdrawal of the shares and their reissue under a new SRN with a delay at each stage. And when it was “finally” completed it was discovered that the bank account details had not been carried over, and there was yet another form to be completed and submitted by mail before the dividend could be paid.

My suggestion is that if you are elderly and have Australian shares, personally or in a trust, get rid of them now whilst it is easy.

AThanks for some useful information.

It’s not a bad idea to sell Australian shares anyway. A lot of New Zealanders have invested across the Tasman, feeling that gives them some international diversification, while investing in a country that they understand.

However, the Aussie share market is probably the one that moves most closely to the New Zealand market. And if you invest in just Australasian shares, you miss out on a lot of industries.

You’ll get much broader diversification in an international share fund. And if that fund is run in New Zealand — perhaps by a KiwiSaver provider that also offers non-KiwiSaver funds — you can avoid complications with tax and the kind of issues you have faced recently.

QWe are a family of five, with kids in high school, and are in the fortunate position of being debt-free, own home, and good income (both parents working).

We have always been heavily insured — the obvious house, cars etc, but also significant life insurance, TPD (total permanent disablement), and basic health insurance. Our view was if one of us gets sick or dies, any debt should be cleared and the surviving parent should be financially comfortable in difficult times.

As we are now financially secure and the kids are getting older, we are considering removing or reducing our life and TPD insurance, and putting this money into a more robust medical insurance. Our thinking is that if one of us dies now we are okay financially anyway. However, if we get sick we will value strong medical insurance. Interested in your perspective.

AYour thinking is spot on. When considering any insurance, it’s best to look at how you would cope if something really bad happened.

If either of you could manage if the other one died or became disabled, you don’t need that cover any more. Meanwhile, medical costs can be horribly high if you are not well insured and reluctant to wait until you can get free medical care. It makes sense for you to concentrate on that.

QI am considering switching my KiwiSaver provider. If my memory serves me correctly (and at 75 it often doesn’t!), I read in one of your previous columns that it wasn’t a good idea to withdraw partially or completely one’s KiwiSaver funds with the idea of re-investing when one believed there was an upturn in likely returns.

My question is — would switching from one provider to another incur the same effect? Would I lose the advantage of my old provider having bought low and be faced with the potentially higher price my new provider would be faced with, in allocating my switched funds? I hope I’ve made sense.

ASense made! Basically, what I was saying is don’t try to time markets, by selling in a downturn and reinvesting when the markets rise.

Nearly everyone who does that ends up worse off, largely because it’s impossible to predict an upturn. You might see the market rise for a few days, but it could easily drop again. By the time you are convinced that the trend is upwards, you will have missed a chunk of the gains. It just doesn’t work.

Within KiwiSaver, only people over 65 would be able to sit on the sidelines for a while anyway. If younger people move their money from one provider it must go directly to another one.

On switching providers, there are three scenarios:

- You stay at the same risk level, for example moving from one balanced fund to another.

If the markets have fallen, the price of the units in the fund you leave will have dropped, so when you sell your units you get less money. But then you buy cheaper units in the new fund. So all is well.

- You switch to a lower-risk fund with the new provider.

This doesn’t work well during a market downturn. Unit prices in your current higher-risk fund will have fallen more than in the fund you are moving to. So you sell at a low price and then buy at an average price. You’ve made your loss real.

But if you make the move when markets have risen lately, it’s good. You sell at a high price and buy at an average price.

- You switch to a higher-risk fund with the new provider.

It’s the opposite. Making such a move in a market downturn is good. You sell at an average price and buy at a low price.

But if markets are rising, you sell at an average price and buy at a high price. Not great.

Having said all this, people sometimes have good reasons for changing risk level — whether it be with a new provider or their current one.

Reacting to a market downturn is not a good reason. But if, for example, you are getting closer to the time you expect to spend the money — for a first home or in retirement — it’s wise to reduce risk. If the markets happen to have fallen at the time, consider moving some of your money now, some in a month or two, and some a bit later, in the hope that there’ll be some recovery in the meantime.

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm, ONZM, is a freelance journalist, a seminar presenter and a bestselling author on personal finance. She is a director of Financial Services Complaints Ltd (FSCL) and a former director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.