Q&As

QFor many of us the proposed capital gains tax on the second home will be a hot topic, especially for those who invested in a second home years ago to secure their retirement.

I’ve got two questions that you might be able to answer:

- If this tax is introduced, let’s say by the first of January 2021, will this tax only be applicable for second homes purchased from that date onwards, or will it be applicable for everybody who in the past bought a second home for investment and it has been in the family for instance for 30 years or more and now decides to sell.

- Is Mr Cullen adjusting the increase in value of your second home by the increase in value purely as a result of the yearly inflation?

I happen to bump into the Reserve Bank website where you can find an inflation calculator.

In 1996, I purchased a modest three-bedroom house in Napier for $200,000.

According to this calculator, based on inflation only, the house should be worth now $768,554, but it is not. The current median house price in Hawke’s Bay is around $438,000.

So if I decide to sell this house, why should I pay a capital gain tax on the “profit” when in fact there is no profit at all.

I hope you can shine some light on this issue.

AOh no, not bad news about the beloved family bach, scene of many a heart-warming gathering — which I assume is what you’re writing about. But the new tax may not be as bad as you fear, or may not happen at all.

While everyone in the Tax Working Group (TWG) supports the idea of taxing rental property gains, just eight of the eleven members support the wider package, which would cover second homes.

Given this lack of unanimity, the government seems less likely to adopt all of the wider package. And even if it does, it has to be re-elected before the changes take effect. Still it’s important that we all understand what’s being proposed. So let’s answer your two questions:

- The proposed tax would apply to all second homes, regardless of when they were bought. But the tax would be only on the gain made after what the TWG is calling Valuation Day, on April 1 2021.

- No, inflation wouldn’t be used. People with taxable assets would have to get an assessment of their worth on Valuation Day. The taxable gain would be the rise in value since then.

That doesn’t mean all valuations would be done on Valuation Day — an impossible task. You would have five years after that to get the valuation done, but with the value set at what it was in April 2021.

“The rules for Valuation Day should provide taxpayers a choice between simplicity and accuracy and provide different options for different types of assets,” says the TWG report.

For property, the options might include comparison with similar properties, perhaps using Quotable Value (QV) valuations, or recent ratings valutions (RVs). The latter are “easily obtainable but may be inaccurate depending on when it was last updated. A choice between the RV before and after Valuation Day may be more accurate in some cases,” says the report.

If you don’t make a valuation, default rules would apply.

Oh, and don’t give up on the Reserve Bank’s inflation calculator. It’s really useful in all sorts of situations. You can use it to work out the effects of general CPI inflation or inflation on food, clothing, housing, wages or transport.

You obviously used the housing calculation, but it’s based on house prices throughout New Zealand. And, as we all know, there are huge regional variations in house price rises. But for many other calculations national figures are fine.

QWhat’s all the fuss about CGT?

If you have to pay it, be thankful because you have made a capital gain and you can keep most of it.

AI love your letter. It goes right to the heart of the issue about fairness — a word that appears no fewer than 54 times in the Tax Working Group’s Final Report Volume 1.

One of the main reasons the group wants tax changes is that under the current system some income is taxed and some is not.

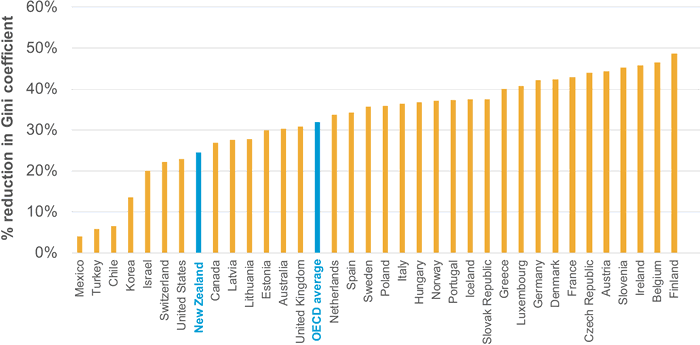

Also, our system is more “regressive” than in many other countries — our taxes and transfers (benefits and Working for Families) reduce income inequality less than in most OECD countries, as the graph shows:

How much tax and transfers (benefits and Working for Families) reduce income inequality in OECD countries (2014–15)

Note: Gini Coefficient measures income inequality.

Image: Tax Working Group, New Zealand Government. Data: OECD.

What’s more, the TWG says, the power of taxes and transfers to reduce inequality in New Zealand has weakened over the last three decades.

Both effects — the lack of a CGT and the regressive nature of our system — “weigh against the sense that New Zealanders are all making a fair contribution, and risk undermining the social capital that sustains public acceptance of the tax system and so our shared prosperity in the long term,” says the report.

In other words, the more people think our system is unfair, the more they’ll try to rip it off.

The TWG adds that internationally CGT mainly affects the wealthiest people.

“In the United States, the richest 0.4 percent of returns accounted for nearly 60 percent of capital gains in 1998. In the United Kingdom, less than 0.1 percent of returns accounted for 60 percent of reported capital gains in 1997–1998 and paid more than 75 percent of all capital gains taxes.

“Capital gains are an important source of income for the wealthy but much less so for the middle class.”

So taxing those gains would help reduce income inequality.

QWe are mindful that we are in a very fortunate position of having two good jobs and property in two areas of New Zealand. We are both in our mid-forties with three school-aged children. We are all in KiwiSaver.

We have a rental in Auckland (carries all our debt) and live in our own place in Tauranga.

Would we be better off to sell the rental? We have just read your latest book, “Rich Enough? A Laid-Back Guide for Every Kiwi”, and the big takeaway was diversification. We are aware we have a lot of money tied up in “housing”.

We currently contribute about $700 a week to the mortgage over and above the rent. If we sell, we are likely to have about $400,000 surplus and be totally mortgage-free.

Would we be better off investing the surplus plus the savings off not having a rental (mortgage and other costs of a second house) in some other investment?

The proposed ring fencing of tax losses will also increase the cost of having the rental.

Are these the types of questions we could discuss with a financial adviser, or is their role to advise where to invest funds if we decided to sell?

AAs I’ve said a few times lately, nobody knows whether you will end up better off financially keeping the rental or investing in, say, a share fund. Both are risky but usually do well over the long term. But diversification is indeed relevant. It’s riskier to have all your savings in housing.

Your comment about the proposed ring fencing of losses on your rental may actually be out of date. Under that proposal, which is part of a tax bill before Parliament, your losses could be used only to reduce tax on future rental income, not on other income such as salaries.

However, if the government starts taxing capital gains on rentals, ring fencing might not be introduced, or might be cancelled.

“The case for residential rental loss ring-fencing is reduced if the taxation of capital gains is extended to cover residential rental investment property,” says the Tax Working Group. “Gains will be taxed when properties are sold, although there will still be some timing benefits for landlords if losses are not ring-fenced because gains are taxed only on realisation.” Realisation basically means sale.

“To the extent the taxation of capital gains could put upward pressure on rents, the removal of ring-fencing on residential rental property may aid in limiting potential rent increases.”

Of course having to pay CGT on gains on your property after Valuation Day might well be a bigger minus than ring fencing. It would all depend on your circumstances.

And yes, these are questions that some financial advisers should be able to help you with. Firstly, look for an adviser who charges you fees and takes no commissions from any providers of financial products. They are much more likely to put your interests first.

On the Advisers page on my website, www.maryholm.com, I explain this more, and at the bottom is a list of such advisers.

Within that list, I would look for advisers who charge by the hour, rather than those who charge a percentage of the money you have invested. The ones who charge hourly are more likely to be unbiased in helping you decide whether to keep your rental.

Check out the advisers’ websites for how they charge, or contact them and ask them.

QYour recent item on the Smart Investor tool pinged an idea I would like your thoughts on.

Assuming the MBIE, the FMA and the CFFC are truly unbiased, how about the Smart Investor tool they created indicating the social value of companies by the colour of the online font?

- Firms with good reason to avoid investing in (e.g. nuclear waste, arms and weapons, favouring murderous regimes) in a red font.

- Firms involved in smoking and gambling, firms who choose to make and/or sell stuff but do not consider the long-term social and personal damage caused, in orange.

- Firms demonstrating high ecological values in their practices or products, being openly generous to public organisations, and so on, in green.

Of course, all choices of the font colour should enhance the neutrality of the three organisations above who publish that tool online. But the actual financial performance of the various investments would be separated from the company’s approach.

The font colour could give a general background signal without making a written comment, and the investor would still make their final choices, but hopefully in a more informed way.

At first glance colouring of fonts looks a bit trite or light-handed, but the closer one looks the more potent the underlying message of the colour could be in helping us select investments.

Thumbs up or down?

ATom Hartmann’s thumbs are up! He’s managing editor at the Commission for Financial Capability (CFFC) and one of the main developers of Smart Investor.

“People not only want to invest effectively, they also want to invest ethically,” he says.

“Smart Investor, at the moment, focuses on people getting ahead financially. This was appropriate given it was developed by a ministry aimed at improving the rules around investing (MBIE), a watchdog keeping investors safe (FMA), and an agency focused on lifting people’s long-term financial wellbeing (CFFC).

“There has been so much progress in the field of ethical investing, and should this become a government priority (i.e. it will take funding), we can easily imagine a collaboration with an expert organisation like Responsible Investment Association Australasia that would upgrade the tool in ways like you’re describing. Bring it on!”

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm is a freelance journalist, a director of Financial Services Complaints Ltd (FSCL), a seminar presenter and a bestselling author on personal finance. From 2011 to 2019 she was a founding director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.