Q&As

QAn idea came to me as to why you couldn’t operate two KiwiSaver accounts in one system!

You have your main KiwiSaver account, and then the same provider operates a mirror KiwiSaver. You put 3 per cent plus employer and government contributions into your main KiwiSaver, as usual, and for the other mirror KiwiSaver you deduct a further 5 or 10 per cent from your own pay.

You could access that mirror account without giving a reason, maybe after a few years. You could use it for housing or emergencies or what suits you. You would keep the first KiwiSaver for retirement.

AThis is such a good idea that something like it is already being considered.

Actually, there’s nothing to stop you from doing this yourself anyway — sort of. Go to your provider and open a non-KiwiSaver account, and set up automatic transfers into it from your bank account the day after your pay comes in.

True, the new account wouldn’t be within the KiwiSaver scheme, but that doesn’t really matter. The only real difference would probably be that the fees might be a bit higher in the non-KiwiSaver account.

But it would be great if having a “sidecar” account was a part of KiwiSaver. That would encourage people to take part. And in these times of rapidly rising prices and mortgage interest, it’s obvious how useful such an account would be for many.

In 2019 the Retirement Commission, Te Ara Ahunga Ora, proposed a sidecar KiwiSaver account to the government — as part of a report that I actually worked on.

The idea is that a KiwiSaver member puts an extra 1 per cent of their pay into a separate emergency fund until it totals $3,000. After that, the extra money goes into their ordinary KIwiSaver account.

The fund “could operate as a safety valve in emergencies such as car repair, dental work, whiteware replacement or other crises.” The money would be much easier to access than hardship withdrawals from ordinary KiwiSaver accounts.

If you made a sidecar withdrawal, from then on, the 1 per cent would go back into your sidecar account until it reached $3,000 again. At the same time, you would be offered financial guidance “that would set the individual down a more secure path in the future.”

You could opt out if you didn’t want to take part, perhaps because you already had other rainy day money.

I really like the proposal. So what’s happened since?

The Ministry of Business, Innovation & Employment has been leading a group looking into some of report’s recommendations, including the KiwiSaver sidecar.

“Officials have been developing advice on potential enhancements to KiwiSaver as part of the wider response to the recommendations of Te Ara Ahunga Ora’s Review of Retirement Income Policies, so that more Kiwis are better prepared for retirement,” says an MBIE spokesperson.

He adds that there is no set timeframe for this work. But I hope we see some results soon.

I noticed in your email to me that you copied in the two Chrises, Hipkins and Luxon. Do let me know if you hear anything substantive from either of them!

QLoved the response to the first letter last week. Outsource the mahi and get someone else to do the work and get on with your knitting or tent making — however you earn your crust.

Got me thinking though. The most successful share investor of our epoch is Warren Buffett if I’m not mistaken. He assesses companies and buys when he’s convinced a company is worth significantly less than the share price. I’d imagine he’s pretty busy now, rather than during the bull market phases.

If only he was in his 40s and not 90s, you’d have to wish you bought shares in his company, Berkshire Hathaway. The trouble of course with buying some now is will his successors have the same success? I’m tempted though, I must say!

AYes, Buffett probably is the most successful share picker around. He seems to be extraordinarily good at choosing “undervalued” companies, as you say — although he, too, has made some bad choices, as he readily admits.

A big difference between Buffett’s strategy and that of many others who run investment companies, share funds and the like, is that he usually buys and holds shares for many years. He doesn’t try to time markets, trading frequently.

Note, too, that Buffett has for decades spoken highly of investing passively — in index funds or, more recently, ETFs — as I recommended last week.

Back in 1994 he said, “By periodically investing in an index fund, for example, the know-nothing investor can actually out-perform most investment professionals.”

And in 2020 he said, “In my view, for most people, the best thing to do is to own the S&P 500 index fund. People will try and sell you other things because there’s more money in it for them if they do.”

QDo the banks pay a margin for locking your money up for longer, in term deposits, versus what they would expect to pay you if you only locked it in for one year at a time?

For example, if they thought interest rates would be constant forever and one-year deposit rates would be, say, 4 per cent a year forever, would they pay a bit over 4 per cent a year for a 5-year deposit?

If that theory is correct, then provided rates track to forecast you should always do better on five-year deposits than five one-year deposits, even if the current five-year rate is less than the current one-year rate, because obviously in that case they would expect the one-year rate to drop off over the five-year timeframe.

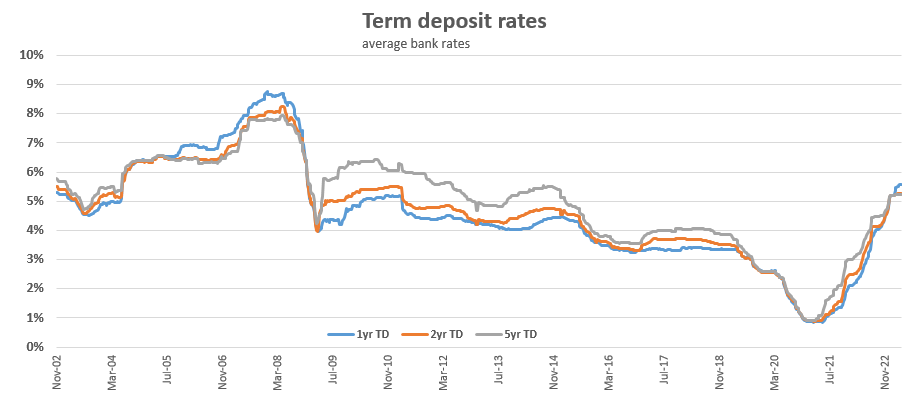

Source: interest.co.nz

AI’ve noticed, over the years, that longer-term deposit rates are usually higher than shorter-term ones. And our graph — based on weekly data from interest.co.nz — shows this has been true for most of this century.

The grey five-year term deposit line is above the one-year and two-year lines most of the time. Indeed, from 2009 to 2014, five-year TDs earned considerably more than the others.

The only exception this century, until recently, was between mid 2005 and late 2008, in the run-up and during the global financial crisis.

Massey University banking professor David Tripe confirms that, as a general rule, banks pay more for longer terms. “But to observe this we would need stable interest rates in current and future periods.” We haven’t had a period when we expected no future rate changes since the 1960s or earlier, he says.

“Interest rates are unlikely to move in only one direction over a five-year period, so there might be an initial drop in rates and then later an increase. Interest rates on government bonds provide as good a basis for forecasting future interest rates as anything else, but it’s hard to predict the political and other changes that may occur over a five-year time horizon.”

Why would the banks tend to pay more for longer terms?, I asked him.

“Longer-term deposits reduce the risks around obtaining replacement funding, and thus improve liquidity risk management, but they also expose banks to greater interest rate risk (although they would usually hedge that using derivatives).”

Replacement funding is new deposits coming into the bank.

“Retail banks don’t match the maturity of loans around the maturity of deposits because they expect to be able to obtain replacement funding if deposits are withdrawn, so the benefit of longer-term deposits are at best moderate (except in times of crisis),” says Tripe.

Still, longer-term deposits do seem to be a higher most of the time. A preference for five-year TDs over five one-year TDs seems wise to me. You will probably win more often than you lose.

QMy mother has just sold a rental property, so she has around $600,000 she’s not sure what to do with. She already has a large amount invested, so may add a little to that, but was telling me she read about term deposit laddering in your column.

I did a few calculations, and for a one, two and three-year ladder with $200,000 in each, and currently a miniscule difference between rates over each term, I cannot see the benefit in doing that. Putting the full amount in two consecutive one-year deposits, the return would be around the same as the three-year ladder.

So laddering only works if the rates increase as the term increases. Unless I’m missing something, or are there other benefits?

ALaddering does indeed work best if you get higher interest for longer terms. But the point is that you usually do — as our graph shows.

If your mother goes with one-year TDs for all of the $600,000, she’ll be annoyed if interest rates have fallen a year from now when it’s time to reinvest. If, instead, she had some of the money in longer-term deposits with rates that by then looked good, she wouldn’t mind so much.

Of course, the opposite could happen. In a year, rates might have risen, and she’ll be happy with her choice. And it’s possible that will keep happening for a few years — although it feels unlikely.

History suggests that after a while we’ll go back to higher rates for longer terms. And “a while” might be quite soon.

It’s higher-risk to put all the money in one-year deposits, just as it would be higher-risk to put it all in three-year deposits. With laddering, you spread your risk, with a bob each way.

Laddering also gives you some money maturing each period, in case you find you need it.

There’s a whole other issue here, too. Perhaps your Mum expects to spend the money in the next few years. Or perhaps she just likes the idea of having some of her savings in low-risk investments. But if neither of those is true, she may want to consider higher-risk investments that will usually bring higher long-term returns.

QI have money that I can afford to put away for four years, and I want to lock in that 5.25 per cent rate before it drops, but get the interest paid out yearly. (You can get the interest paid out twice yearly or quarterly even).

I will do four separate lots throughout the year. This means I will get that high interest rate for four years, with an interest payment every three months.

I doubt the interest rate will go any higher than 5.25 per cent. It will most likely go down in the next year or so. What are your thoughts on this?

AYour reaction to current interest rates — to put all the money away for four years — is the opposite to the previous correspondent’s.

With your plan, if rates fall after you’re fully invested you will be content, whereas his Mum definitely won’t be if she follows her son’s suggestion.

I don’t know where rates are going. And there’s certainly no consensus from economists. In these turbulent times — with possibilities including higher inflation, recession, an upswing in Covid cases and further dramatic weather — making predictions seems downright mad.

If I were you, I would ladder the money, with a quarter tied up for one year, a quarter for two years, a quarter for three years and a quarter for four years.

Having said that, 5.25 per cent in a safe four-year investment does look attractive. And hopefully the Reserve Bank will win and inflation will drop below 5 per cent fairly soon, so the buying power of your money will grow. Your plan is certainly not terrible.

Correction

In last week’s first Q&A I said, “Genesis Energy, Mercury and Meridian Energy operate under a mixed ownership model, with the government holding majority stakes, but Contact and Trustpower are private sector companies.” I got that information from the MBIE website.

However, Mercury has contacted me to say, “Mercury acquired Trustpower’s retail business in 2022, so it’s now a brand which comes under Mercury.”

I’ve pointed out the outdated info to MBIE, and they have updated their website to exclude Trustpower. Apologies for the mistake.

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm, ONZM, is a freelance journalist, a seminar presenter and a bestselling author on personal finance. She is a director of Financial Services Complaints Ltd (FSCL) and a former director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.