Q&As

- All on government tax proposals

QAfter reading last week articles on the proposed capital gain tax, I have several concerns.

About a month or so ago, I was at a bank and was advised to start unit trust investments for my daughters’ further university education (in about 8 to 12 years time).

My husband and I decided to choose the growth strategies, which invested high percentages in world shares and world fixed interest. We invested an initial lump sum of $1000 and are contributing $50 per month.

Now my concern is the proposed capital gains tax that will kick in next April. Will this tax eat into our investment?

Should we close the unit trust now and put money into local financial companies, some offering higher interest rates? Or should we switch into conservative strategy or moderate strategy unit trusts, with lower emphasis on overseas products?

I also wonder what I should do with my retirement plan, which is also invested in a growth managed fund? I also have about $9000 in Tower Tortis international share fund, which I invested several years back and have not gained any income since investing.

I wonder whether I should sell them before the proposed capital gains tax comes into force.

AHold your horses. The proposals could well change between now and next April. Even if they don’t, the changes might actually help two of your three investments.

Firstly, let’s look at your choices. The “growth” unit trust for your daughters’ education is probably good, although I have two concerns:

- If you invest in a product that includes shares, it’s best to have a time horizon of ten years or more. You can then be almost certain you won’t lose money; over shorter periods you might.

Still, eight years is not too far off ten. And the fixed interest in the fund will modify fluctuations. You would be really unlucky to lose in such a fund over eight years, and there’s a good chance you will do well.

- You must be sure you won’t bail out when returns fall — and they will fall at times. But they always recover, albeit slowly sometimes.

I also like the way you are drip feeding into the investment. That means you will sometimes buy when unit prices are high, but you will also sometimes buy when they are low. With lump sums investments, there’s always the danger you will buy the whole lot at what turn out to be high prices.

Your retirement savings choices are good, too — once again as long as you stick with them for the long haul.

Don’t worry about not getting income from Tower Tortis International. The low dividends on world share funds are often eaten up in fees. But the capital gains — reflected in the rising value of your units — can be high.

True, over the five years ending March 31 the return on Tortis International has averaged minus 3.6 per cent a year, because of the international share price dive earlier this decade. But since 2003 the return has averaged a healthy 15 per cent a year, and in the last year a whopping 35 per cent.

How will the proposed changes — if they go ahead — affect your investments?

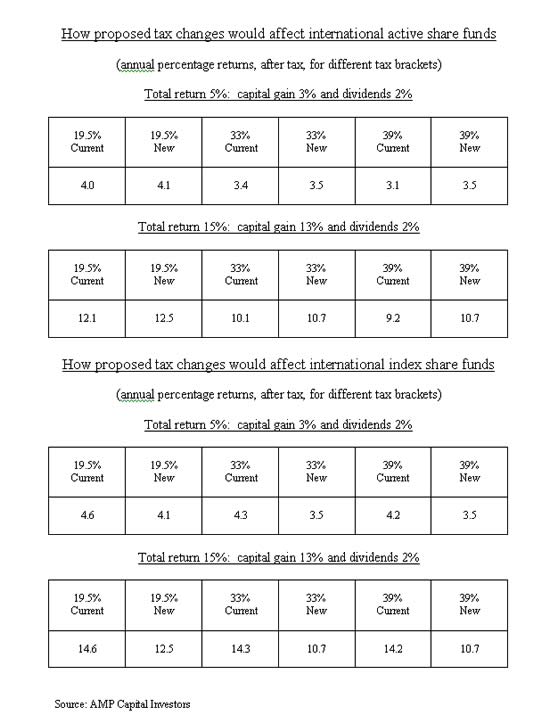

Our table, calculated by Andrew Brockway of AMP Capital Investors, shows low and high returns on active funds, in which the managers choose which shares to buy and sell, and on index funds, which invest in the shares in a market index.

Tortis International is an index fund. The share funds in your retirement plan and your daughters’ saving plan could be either index or active. Index funds usually have the word “index” or “passive” in their title. If you’re not sure, ask the bank.

As the table shows, after-tax returns on active international funds will be higher after the changes, because 85 per cent of their capital gains will be taxed, compared with 100 per cent now.

However, returns on international index funds will be lower — especially in years of high capital gains. Currently, these funds pay no tax on capital gains, but under the proposals they will pay tax on the same 85 per cent as do active funds.

Three points to note:

- The current taxes on index funds are really low. The changes would move them from a tax-favoured position to a tax-neutral position. They are still good investments, and they tend to charge low fees.

- Under the proposed changes, fund investors in the 19.5 per cent tax bracket will be taxed at their own rate. Currently, all fund investors are taxed at 33 per cent. That explains why those in the lower bracket won’t be as badly affected in index funds as those in higher brackets.

We assume people in the 19.5 per cent bracket can use their surplus imputation credits to offset tax on other income — which is the case for most people.

- Active share funds that invest in New Zealand and Australian shares will benefit more from the changes than those investing in international shares, because their capital gains will no longer be taxed. But remember that the taxable dividends in Australasian funds are higher. So the total tax difference may not be great.

The advantages of international diversification, and the high average returns on shares, will still make it worthwhile to have a considerable portion of long-term savings in international shares.

I certainly like them better than finance companies, which pay higher interest rates than banks because their investments are riskier. You could lose lots if a company defaulted. Stick with what you’ve got.

QI had to have a comment on your reasons for arguing last week that Grey List shares get favourable treatment compared to NZ shares because the local shares and those of Australia pay out more in dividends.

- That would easily be dealt with using just the ‘notional’ 5 per cent dividend treatment without the capital gains tax aspect.

- Favourable treatment of real estate investment would be the first problem to tackle had the politicians the guts to do so.

Moving on, I firstly refer you to the holdings of the NZ Super Fund. They are not heavily invested in Grey List shares for nothing.

Then it must be assumed that those who invest directly in overseas shares are probably more successful than your average punter or they would not do it. They then ultimately benefit the country by spending at least some of it here. Investing in NZ shares is more a zero sum game for the NZ economy while overseas investment gains are a genuine addition to wealth when repatriated.

Treating Australia in the same way as New Zealand will assist their economy by further cash flowing their way, not ours, and their market is much more likely to overheat than ours because of compulsory superannuation anyway.

On a personal view, bringing back $500,000 would probably end up at least in part, in the already overheated property market.

AYou seem to think I’m against investing in overseas shares. Nothing could be further from the truth.

Most of my long-term savings are in international index funds and, as you point out, I’m in good company. The NZ Super Fund, or Cullen Fund, has more than half its money in international shares,

On some of your specific points:

- A notional dividend system might be better. But probably not.

Some years ago, when I was working for the second Todd task force on retirement savings, we looked into investments taxes.

It’s horribly complex. Every suggested change that would help one investor hurt another.

Since then, whenever someone says, “Why don’t they just” do whatever, I think there’s probably a good reason not to, or the change would already have happened.

Given the brain power of those working on the proposals, I would be really surprised if you or I could come up with an idea they haven’t considered.

- It’s probably more fruitful to concentrate on whether the broad results are what New Zealand wants — which leads us to your point about taxation of real estate.

Basically, rental property has no tax advantages over shares under the current system. Rent and dividends are taxable and capital gains are not, unless you bought with the purpose of selling at a profit.

In reality, though, the enforcement of the laws on depreciation and capital gains on property seem to be too lax.

I absolutely agree with you that, if we want fair tax treatment of all investments, politicians should push for tougher enforcement.

- Your comment about Australia puzzles me. If, as you say, New Zealand benefits from people holding international rather than local shares, surely that applies to Aussie shares too?

And I don’t see why the Australian market, which has long since adjusted to compulsory super, should be any more likely to overheat than ours.

- Don’t bring your money back home, at least not yet. Let’s wait and see the final proposals.

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm is a freelance journalist, a director of Financial Services Complaints Ltd (FSCL), a seminar presenter and a bestselling author on personal finance. From 2011 to 2019 she was a founding director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.