Q&As

QI set up my share portfolio starting about eight years ago mainly in Smartshares. It is very diversified, with overseas stocks, after reading books advocating to diversify out of New Zealand, as New Zealand is just a rounding error on the world markets.

Now I regret taking that advice. The NZX50 is persistently ahead of my portfolio in returns. In hairy hindsight I wish I’d put a lot more into the New Zealand market, ie the NZX50 and Mid Cap funds. I’d be running at about 15 per cent for returns instead of 11 to 12 per cent.

I understand that all markets round the world have periods as the star performer, but this is a sustained period for New Zealand.

Do you think the NZX50 is going to revert to the mean or continue to beat world markets on a sustained basis? Just trying to figure out whether it’s too late to start investing more in New Zealand, and where to put any further new investment going forward. Is this surge due to the advent of KiwiSaver, a2 Milk, Ryman etc or other factors?

AI don’t know. I’ve read various theories on why the NZ market has had such a good run lately, but how does anyone really know? Do they survey every buyer and seller of shares?

What I do know is that in the long run it’s better to invest around the world. In fact, I’m probably one of the authors who have annoyed you on that issue. And I know you’ve read my latest book, “Rich Enough? A Laid-back Guide for Every Kiwi”, because you made kind comments about it in a post-script. Perhaps you’re really saying, “Hey, you shouldn’t have said that”, but you’ve put it more politely!

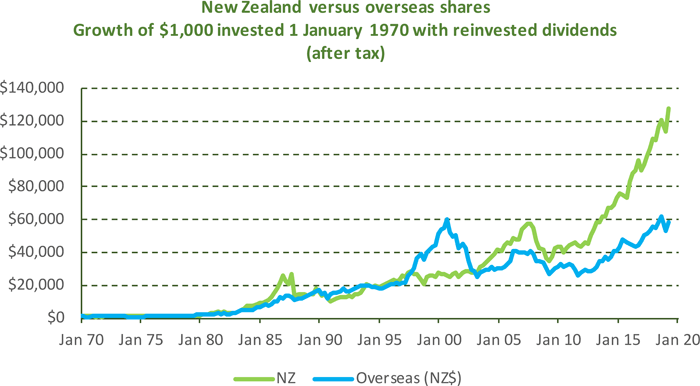

Anyway, there’s no denying that if you had invested locally rather than globally since the 2008 global financial crisis, you would have done better, as our graph shows. But what if we were now in the late 1990s — at the height of the tech bubble that hugely boosted world shares but not NZ shares? At that point, you would have been glad to be in world shares.

And then look what happened.

I’m not saying NZ shares will plunge. But given how well they’ve performed for several years it wouldn’t be surprising if the growth at least slows. The graph shows that rapid rises — including in New Zealand in the 1980s and early this century — are often followed by substantial downturns. The long-term trends are upwards, but with big wobbles.

There’s nothing wrong with having, say, a quarter of your share investments in New Zealand. You benefit from dividend imputation, and many people like the idea of investing locally. But with world shares you get much broader diversification of industries and exposure to a range of economies. That’s where I’ve got most of my long-term savings.

QRecently I received an email from the ANZ informing that I would need to top up my KiwiSaver account to meet the yearly threshold to get the government contribution. I had been away for a six-month holiday, so nice of the ANZ to inform me.

However, the payments from my wage slips are far higher than what shows on my ANZ KiwiSaver transaction report. I called the ANZ who told me that the IRD can and do hold payments for up to three months before releasing them to the bank. Is this legal? And why do they do this?

ABefore we get to your questions, let’s clarify for others that the government contribution — formerly called a tax credit — is based on all the money deducted from an employee’s pay during the KiwiSaver year, which runs from 1 July 2018 to 30 June 2019. It also includes any money you pay directly to your provider in that period.

You get 50 cents for every dollar you contribute, up to a maximum of $521 if you contribute $1042 or more. Even if you put in $1, the government would give you 50 cents. The money comes into your KiwiSaver account in July or August.

And yes, it’s great when your provider points out that you might miss the maximum government contribution.

Who might that apply to? If you earn more than $34,762 a year, and have contributed 3 per cent of your pay or more throughout the year, you will have contributed more than $1042. But the following might not have:

- Employees on less than $34,762 a year.

- Employees who have contributed for only part of the July-to-June year.

- Employees on a contributions holiday.

- Non-employees and the self-employed.

If that includes you, I suggest you check your total contributions and if necessary top up. If you can’t afford it, put in what you can. Remember, this gets you free government money.

To top up, send the money directly to your provider, preferably by mid-June to give them time to process your deposit. To contact your provider, see here. If you don’t know who your provider is, ring 0800 KiwiSaver. You’ll need your IRD number.

Okay, on to your questions. Yes it’s legal. But why does it take up to three months for payments to clear Inland Revenue?

After your employer deducts the money from your pay, they send it to IR by the 20th of the following month. Then IR checks the information — which can take a month or more — and then transfers the money to your KiwiSaver provider. While your money is with IR, it earns 0.91 per cent interest. It’s not much, but it all helps.

The long process is “simply because the KiwiSaver payments are part of the normal payroll cycle,” says IR on its website. For more on this see here.

How can you keep track of your contributions, including the money sitting in IR?

“A member can log in to their My KiwiSaver account to see the total amount that has been deducted from their salary and wages and received by IR,” says a spokesperson. My KiwiSaver is on the top right side of the home page at www.KiwiSaver.govt.nz.

However, he adds, “Any amount that has been deducted from their pay but not yet received by IR will not be visible in MyKiwiSaver.”

That sounds worrying, but it’s taken care of. “In some cases a scheme provider may claim the government contribution for a member before all of the member’s contributions for the year have been received by IR, meaning that IR will initially pay less than the maximum of member contribution to the provider,” says the spokesperson.

“However, as additional contributions are received by IR this triggers an automatic recalculation of the government contribution and, where appropriate, an additional government contribution payment.”

If all this sounds too complicated, make a rough guess at how much you need to top up, and then add a bit extra. If you put in more than $1042, it’s still your money, so it can’t be all bad.

The process should get easier soon.

“Once the processing of employee contribution information is passed into IR’s new START platform (proposed for April 2020) members will be able to see a much more up to date picture of contribution flows from their employer and across to their scheme provider,” says IR.

“The information should be able to show deductions from a member’s pay within approximately 10 days of the member’s payday, rather than 6–8 weeks under the current system.” Phew!

QI’m a young professional whose parents are divorcing. I have no properties or assets in my name currently.

As part of the dissolution agreement my father intends to gift a part of his half share of their property to me in two years’ time. Would this affect my eligibility to withdraw my KiwiSaver funds to buy a first home once the share has been gifted?

AThis is probably a sad time for you, but that gift is a lovely idea.

And no, it won’t affect your first home plans — whether you just want to withdraw your money or also apply for a HomeStart grant. Many people using KiwiSaver to buy their first homes these days receive gifts from their parents.

QRecently Brian Gaynor explained in his column why KiwiSaver funds were unable to match the performance of the NZ share market. I hope you can explain the rules governing all KiwiSaver funds. Are they all required to invest their funds adhering to a prescribed formula of asset class diversity?

If so it would be much better if the KiwiSaver system permitted investors to invest in any investment fund they choose. The saver’s KiwiSaver status would be based on the person rather than the current requirement that they choose from a limited number of funds.

For investors unable, or lacking interest or expertise, to choose an investment fund, the current default arrangement could continue.

As with every Government-derived scheme the limitations are gradually being revealed. Astute investors eventually realise that the carrots may not be worth it, and savings freedom is worth more than they realise.

AYou’ve leapt to a wrong conclusion. There aren’t many limitations on what a KiwiSaver fund can invest in.

Says a Financial Markets Authority spokesperson, “The overarching principles for KiwiSaver funds are that they must maintain liquidity and be able to calculate continuous or daily unit pricing.”

Liquidity is about the ability to buy and sell assets quickly. A KiwiSaver fund can’t have more than 20 per cent of its assets in investments that would take a long time to get out of, such as bank deposits with terms longer than three months or other investments that would normally take more than ten days to sell.

But there are no rules about investing in a range of different types of assets.

Gaynor was writing mainly about multi-sector KiwiSaver funds, which typically invest — to varying degrees — in global shares, Australasian shares, bonds, cash and perhaps property. He pointed out that 95 per cent of all KiwiSaver money is in such funds, presumably because most members like the risk reduction you get from spreading your money over more than one type of asset.

However, 5 per cent of the money is in single sectors — all cash or all global shares, Australasian shares, commercial property and so on.

One unusual KiwiSaver option is offered by Craigs Investment Partners. You can select your own investments from more than 180 Australasian and international shares, funds and other investments. If you want, you can put all your money in one share — perhaps a big NZ company, or Warren Buffett’s company Berkshire Hathaway.

For most people, I wouldn’t recommend investing in a single company, but the choice is there. Craigs’ fees vary, depending on your investments. They get high marks for flexibility.

Another unusual option is Booster’s Geared Growth Fund, which may borrow to leverage up its exposure to shares. “It is suited to investors who are comfortable with a high level of risk in order to potentially achieve higher returns,” says Booster.

In the past, there was a KiwiSaver fund that invested in options, and no doubt other alternatives will emerge.

What’s more, any KiwiSaver provider will let you invest in more than one of their funds. So the choice is pretty wide. However, for most people — who don’t have many other investments except perhaps their home and maybe a rental property — the multi-sector funds work best.

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm is a freelance journalist, a director of Financial Services Complaints Ltd (FSCL), a seminar presenter and a bestselling author on personal finance. From 2011 to 2019 she was a founding director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.