Q&As

- A poem from the past shows how our attitudes to debt have changed. Will they change back again?

- Reader wonders how long she has to wait for the government to change the law about employer KiwiSaver contributions

QYou may derive some amusement (I doubt instruction!) from the following, found while I was trawling Papers Past in pursuit of another project. It would make a change from the complexities of KiwiSaver!

Unfortunately the author of the doggerel is not stated so he/she cannot be credited, but perhaps decent anonymity is more appropriate.

It was in the Otago Witness of 8 May 1874, P 26, with no attribution. I don’t know anything else about it.

It may well have been reprinted from an overseas newspaper, as seems to have been the local practice in those days. Should be well out of copyright by now.

LOVE, DRINK, AND DEBT.

Son of mine! The world before you

Spreads a thousand secret snares

Round the feet of every mortal

Who through life’s long highway fares,

Three especial, let me warn you,

Are by every traveler met;

Three, to try your might of virtue

They are Love and Drink and Debt.

Love, my boy, there’s no escaping,

’Tis the common fate of men;

Father had it; I have had it;

But for Love you had not been.

Take your chances, but be cautious;

Know a Squab is not a dove;

Be the upright man of honour;

All deceit doth murder love.

As for drink, avoid it wholly;

Like an adder it will sting;

Crush the earliest temptation.

Handle not the dangerous thing.

See the wrecks of men around us

Once as fair and pure as you

Mark the warning! Shun their pathway,

And the hell they’re tottering through.

Yet though love be pure and gentle,

And from drink you may be free,

With a yearning heart I warn you

’Gainst the worst of all the three!

Many a demon in his journey

Bunyan’s Christian Pilgrim met -,

They were

Lambs, e’en old Apollyon,

To the awful demon Debt !

With quaking heart and face abashed

The wretched debtor goes;

He starts at shadows, lest they be

The shades of men he owes,

Down silent streets he furtive steals,

The face of man to shun,

He shivers at the postman’s ring,

And fears the dreadful dun.

Beware of Debt ! Once in you’ll be

A slave for evermore;

If credit tempt you, thunder “No!”

And show it to the door.

Cold water and a crust of bread

May be the best you’ll get;

Accept them like a man and swear-

“I’ll never run in debt.”

AI love your debty ditty. I was going to edit out the second and third verses, to keep it shorter, but then I decided that love and drink also belong in a Money column. As many know only too well, love gone wrong can be horribly expensive. And budget advisers often say that booze is one expense most of us underestimate when we draw up a budget. But let’s concentrate here on debt.

The poem illustrates beautifully the old-fashioned attitude to debt — an attitude that I suspect was reinforced during the Great Depression. Many of my parents’ generation came out of the early 1930s determined to take on as little debt as possible for the rest of their lives.

Since then, though, the pendulum has swung a long way in the other direction, towards the idea that debt is good. It will be interesting to see if the present economic malaise — with many people in trouble because they can’t repay mortgages and other loans — leads to a swing back towards “debt is bad”.

In fact, of course, it can be either. It’s important to understand that borrowing to invest — sometimes called gearing — makes a good investment better but a bad investment worse.

A couple of years ago, when I wrote my book “Get Rich Slow: How to grow your wealth the safe and savvy way”, I wanted to show the relationship between gearing and risk.

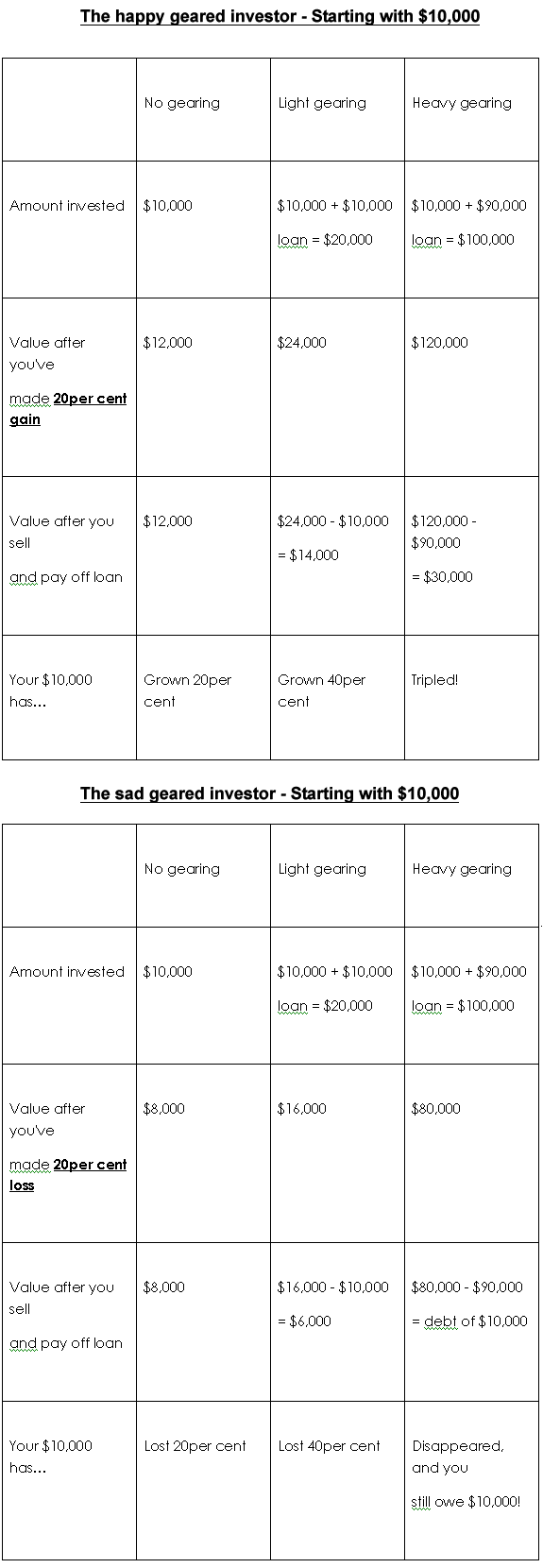

I included two tables, reproduced here, to show two scenarios — one in which the item you invest in gains 20 per cent in value, and one in which it loses 20 per cent. I looked at what happened with:

- No gearing.

- Light gearing — for example, a share investment.

- Heavy gearing — for example, a property investment.

The heavier the gearing, the more you gained when the investment grew, and the more you lost when the investment decreased.

When I presented these tables in seminars, people in the audience often protested that there was no way property could fall 20 per cent. Something tells me I wouldn’t see the same protests now.

By the way, a “dun” is someone who duns, or makes persistent demands for payment. When he retires, I guess, he’s done with dunning.

QDo you have any update on the Government’s recent announcement that they will pass a law through Parliament to stop employers from deducting the 1 per cent employee contribution from KiwiSaver members pay?

My employer gave all staff in a recent pay round 4 per cent plus 1 per cent for KiwiSaver or if not in KiwiSaver, they awarded 5 per cent cash. So effectively they are pocketing the money the government gives them as reimbursement of their KiwiSaver contributions.

I have held off signing this offer and they are holding back my new pay rise until I do sign it. But in one of your columns you recommended that we not sign the agreement or we would have to wait until next year to get a better deal. So I am following that advice.

I am keen to get this sorted. Negotiation with our employer is not going anywhere. They see it that they are operating completely within the rules of KiwiSaver.

ASigh! The column’s escape from “the complexities of KiwiSaver” didn’t last long. The questions about the scheme are still flooding in, and can’t be ignored, and this one seems particularly pressing.

Hopefully, your wait will soon be over.

Minister of Labour Trevor Mallard, who wants the law changed so that employers can’t give KiwiSaver members smaller pay rises than other employees, says that your employer “right now is not technically acting illegally.” But he adds, “This is definitely one of the types of behaviours that the change will stop, as it is unfair to the KiwiSaver employee. Under the proposed changes, an employee in this situation will be able to take a personal grievance against their employer.”

Mallard says he expects “the changes will pass through the House very shortly. This will be before the House rises for the election.”

The House must rise by October 6, but there’s a good chance you’ll see action quite a lot sooner than that. And while there has certainly been some strong opposition to the changes from some employer groups, observers say Mallard seems to have the numbers to pass the Bill.

The minister adds that it’s not appropriate for him to offer advice on whether you should sign your agreement. “However, under the proposed change any agreement that is reached before the Bill is tabled in the House will be unaffected until the next time it is renegotiated.”

It sounds as if it will be worth your while to hold out a bit longer.

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm is a freelance journalist, a director of Financial Services Complaints Ltd (FSCL), a seminar presenter and a bestselling author on personal finance. From 2011 to 2019 she was a founding director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.