Highlights from Holm Truths

For a few weeks, this column is running highlights from Mary Holm’s quarterly newsletter Holm Truths. Mary’s regular Q&A column will resume on October 27.

STAY AWAY

New Zealanders’ increasing tendency to travel overseas is a wonderful development. We enjoy it, we learn tolerance and we pick up ideas — ranging from what to eat to how to make a living.

The trend has made us all more aware of the changing value of the Kiwi dollar. When it rises, we perhaps take a longer or more expensive trip. But when it falls, we don’t all stay home. Some of us modify our plans; others carry on regardless, maybe spending less on other items.

Over the years, too, we’ve become more likely to own international shares — directly or by investing in a world share fund or a managed fund that includes international shares.

The government recently made changes that in many cases will increase taxes on share investments beyond Australia. And many New Zealanders have responded by saying they will withdraw from international shares.

Some plan to switch to Australian listed shares, which will be taxed much the same as New Zealand shares (but without dividend imputation). Others say they will bring their money home, investing in local shares, property or elsewhere.

But bringing your investments back to Australasia may not be a good idea. There are some strong reasons for keeping some of your long-term savings offshore — or, indeed, to make such investments if you don’t already have them. They are:

- Broader spread

One attraction of investing in international shares is diversification. If you invest in many different economies, when some are performing badly there’s a good chance others will be growing.

You also broaden your exposure to different industries. Compared to world shares, the New Zealand share market is extremely top heavy in telecommunications and utilities, and grossly under-represented in information technology and energy.

Australia, meanwhile, is extremely top heavy in materials and very heavy in financials, and is grossly under-represented in information technology, and low in health care.

Putting half your share money in Australia and half in New Zealand will, of course, broaden your industry base. But you would still be overweight in materials and telecommunications, and underweight in energy and health care. And you would remain extremely underweight in information technology.

- Lower volatility

If you concentrate only on the last decade or so, the world share market has been more volatile than the New Zealand and Australian markets. World shares boomed in the late 1990s and crashed early this decade, while Australasian shares held to a pretty steady upward path.

But when we look at the mid 1980s to mid 1990s, New Zealand and, to a lesser extent, Australia were the boom and bust markets. The two Downunder markets experienced considerably higher volatility then than the world market has at any time in the last 30 years.

Looking at the maths over the 30 years as a whole, the New Zealand market is somewhat more volatile than the world market, while Australia is similar to the world market.

Another way to look at it: In the last 30 years Australasian markets were much more likely to record quarterly losses than the world market. In 33 per cent of the quarters the New Zealand market fell and in 30 per cent the Aussie market fell, compared with 21 per cent for the world market.

This in part reflects global market diversification. When one market is falling, another is rising.

- Dominant companies

The New Zealand share market is heavily dominated by a few companies. That’s fine when the dominant companies perform well, but not when they don’t.

Telecom currently makes up 17 per cent of our market, followed by Fletcher Building at about 11 per cent and Contact Energy at about 10 per cent. Together, our top ten companies account for two thirds of the market.

Australia is only somewhat better. BHP Billiton makes up 9 per cent of that market, and the top ten companies account for 41 per cent.

By contrast, the biggest company on the world market is Exxon Mobil, making up just 1.7 per cent of the S&P Global 1200 index, followed by General Electric at 1.4 per cent. The top ten companies account for less than 10 per cent of the index — and that index covers only the biggest companies. They would make up an even smaller proportion of all world shares.

The world market is much less dependent on the performance of one or a few companies.

- Returns

Over the past 30 years, the average annual return on the New Zealand share market, before tax and including dividends, was 15 per cent — just above Australia’s 14.6 per cent. The world performance was a little weaker, at 13.5 per cent.

Just as with volatility, though, the relative performances vary depending on the period. From 1976 to 1991, for instance, the world market outperformed New Zealand and Australia, and it did so strongly again in the late 1990s.

Looking ahead, the world market is probably just as likely to beat Australasia as the reverse.

- Offsetting

Predictably, the New Zealand and Aussie markets often move more closely together than the New Zealand and world markets.

If you have some money in New Zealand shares and some in world shares, it’s much more likely that a bad performance in one market will be offset by a good performance in the other than if you have some in New Zealand and some in Australia.

Over the last 30 years, in 36 per cent of the quarters world and New Zealand shares moved in opposite directions. This happened only 19 per cent of the time with Australian and New Zealand shares.

Footnote: While it’s possible to make international share investments hedged to the New Zealand dollar, most people don’t. So the data in this issue assume your investments are unhedged.

ALL OVER THE PLACE

The relative volatility of New Zealand’s share market becomes clear when you compare its performance with the markets in Australia, Canada, France, Germany, Italy, Japan, the UK and the US, since 1974.

- New Zealand is the only country to switch in one year from best performer, in 1986 (111 per cent), to worst, in 1987 (minus 44 per cent). The crash hit us hardest.

- New Zealand is one of only four countries to switch in the opposite direction, from worst to best in a single year. In our case, the switch was from 2000 (minus 21 per cent) to 2001 (16 per cent).

- Our highest two returns — 129 per cent in 1983 and 111 per cent in 1986 — were the second and third highest of any country in the period. (Top was the UK’s 151 per cent in 1975.).

- Our 1987 return was the lowest of any country in the period.

YES, BUT…

Two reasons are often given for not investing in offshore shares:

“Dividends are lower and you miss out on dividend imputation.”

Overseas companies, especially beyond Australia, do tend to pay out lower dividends than New Zealand companies.

They’re more likely to keep profits to grow their business, which tends to boost the growth in share prices. So what you lose on the swings you gain on the roundabout.

And the lack of dividend imputation, usually on dividends that are low anyway, doesn’t make a great deal of difference to over-all returns.

“Foreign exchange movements boost risk.”

Not really. Changes in the dollar’s value will sometimes increase volatility but just as often they will reduce it.

If, for example, international share markets are falling, foreign exchange movements can more than offset that, so that the value of your offshore shares still rises.

Note, too, that having overseas investments hedges you against loss if the Kiwi dollar falls. Foreign travel and imported goods such as cars will cost more, but the value of your investments will rise to help cover that.

Over all, having international investments reduces risk more than it increases risk.

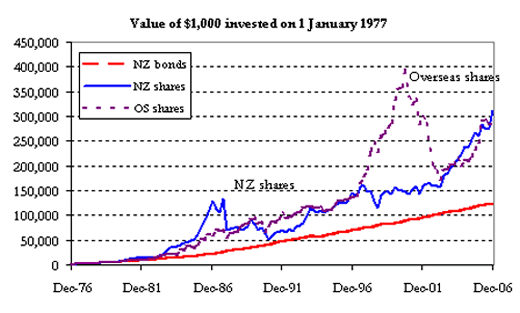

GRAPH: UPS AND DOWNS

While New Zealand and world shares sometimes move in much the same way, sometimes when one is falling the other is rising — which can be of great comfort to those who have invested in both markets.

As it happens, in the period in our graph the two markets have performed roughly equally over the 30 years covered. But of course that isn’t always so. In the mid 1980s, for example, New Zealand way outperformed the world, and then way underperformed after the October 1987 crash. Much the same happened to the world market in the late 1990s and early this decade.

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm is a freelance journalist, a director of Financial Services Complaints Ltd (FSCL), a seminar presenter and a bestselling author on personal finance. From 2011 to 2019 she was a founding director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.